An escrow account, sometimes referred to as an “impound account,” is a special account that the mortgage company maintains for the borrower’s home insurance and taxes. The escrow account is funded monthly with a portion of each mortgage payment that is made. The funds are then used by the lender to pay tax and insurance bills when they come due.

Property taxes and insurance are relatively large bills that come due a few times a year. Making consistent monthly mortgage payments and use of the escrow account makes budgeting easier for the borrower. After all, is it easier to send $200 per month away in preparation or to try and come up with $1200 when the first half of property taxes are due? Most would agree budgeting the monthly payment is preferable… The lenders certainly do, and they use the escrow account to help protect themselves from potential tax liens and uninsured losses.

Now that we’ve covered the basics of what an escrow account is, we can move on to how Old Harbor addresses an escrow account from the insurance side.

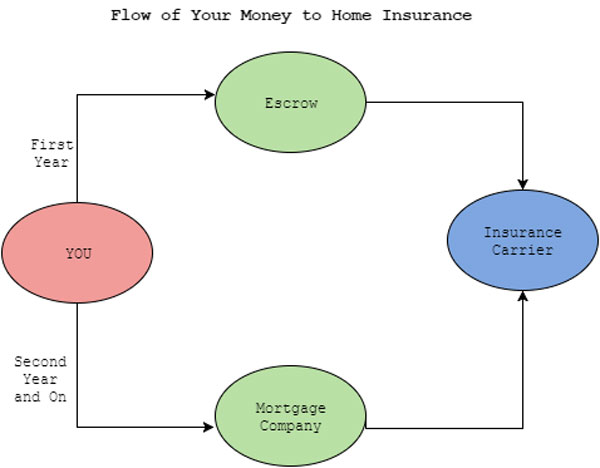

For the new purchase of a home, a portion of escrow funds are set aside to pay the first year of insurance in full. When purchasing a home, you select an escrow officer to oversee transferring of funds and legal documents. Old Harbor works with this individual to make certain your first year’s premium is submitted to your home insurance carrier in a timely manner.

After escrow has closed, you’ll begin making regular, monthly mortgage payments. With each mortgage payment made, a portion of it is deposited to your escrow account and set aside for taxes and your home insurance renewal the following year.

If you change insurance carriers in the middle of the year, it is important to review your escrow account. Old Harbor will work closely with you and your mortgage company to facilitate the transfer of insurance and ensure you do not encounter a shortage of funds available in the process.

DISCLAIMER: This article is provided for general informational purposes only and should not be relied upon for legal advice. Old Harbor Insurance Services, LLC recommends you consult your risk manager, attorney, business advisor, or insurance representative for all questions or concerns.