A Short Story about The Smiths

Joe and Laura Smith are your classic high school sweethearts; they’ve been together since they were sophomores. This past year celebrated their eight-year anniversary and their 33rd Birthdays. Joe’s a hardworking manager for a mid-size technology sales company and Laura works part-time as a photographer and styling specialist. They live a comfortable lifestyle on their combined middle-class income, but they’ve admittedly been reluctant in planning for retirement. After all, they have two growing kids… Between work and raising children, who has time to think about something three or more decades away? And furthermore, where in their budget would they pull the money from to set aside for retirement?

Fast forward, and it’s now an early Tuesday afternoon. Laura has found an hour of quiet time to catch up on the dishes and make her way through the family bills. As she makes her way through the pile of mail, she notices that their auto insurance has gone up significantly – they’re with the gecko. Tired of poor service and increasing costs, Laura decides to call Becki, the local, independent agent that helped her and Joe with home insurance when they bought their first home last year.

After the quick call with Becki to provide their auto insurance information and explain her frustration, Laura moves on with her day. The next day, Becki calls, but unfortunately Laura’s busy and misses the call. Later when Laura is able listen to the voicemail, she’s pleasantly surprised with what she hears. “Hi Laura, it’s Becki. I wanted to let you know that we were able to beat what you were previously paying on your auto insurance with better coverage. Also, by moving your auto insurance, your home insurance cost would go down by almost $250. Please give me a call back at your convenience to review.”

The next time Laura and Becki speak, Laura’s pleased to learn the benefits of placing her home and auto insurance with the same company. Becki explains to her that the insurance carrier was able to offer a multi-policy discount on the Smith’s home insurance. Likewise, the insurance company offers a significant multi-policy discount on their auto insurance resulting in a monthly savings of $36. When all is said and done, the Smiths have now: 1) saved themselves $687 in insurance costs, 2) established one, local point of contact for all their insurance needs, and 3) strengthened their position with their insurance company in the event of a claim.

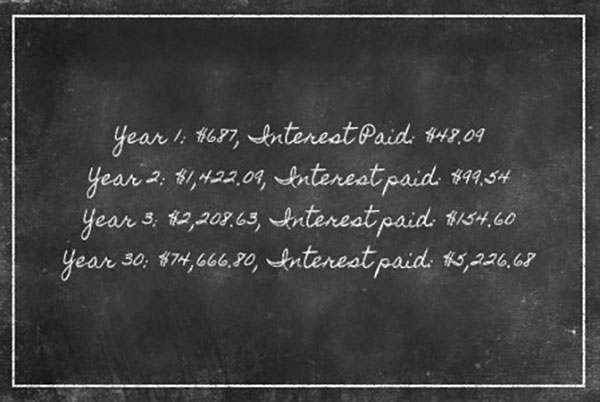

Rather than spend the savings elsewhere, Laura and Joe decide to “pretend” that they’re still paying high insurance rates. Each month, they automatically transfer the premium savings into a Roth IRA where their money can grow tax-free for retirement. One day at work, Joe runs the numbers to see what would happen if they simply set their premium savings aside each year until his target retirement age of 63. He thinks to himself, “We made it work when we were paying the higher costs before, we can surely commit to $57 per month.” He’s shocked with what he finds – If they continue to set that amount aside each month for thirty years and achieve an average return of seven percent, his investment would be worth over $74,000 paying out over $5,200 annually!

The Facts

The average Californian spends $2748 per year for home and auto insurance.

- The average home insurance premium in California is $996*

- The average auto insurance premium in California is $1752**

Most insurance carriers offer up to a 25% multi-policy discount. If you’ve been missing the savings, let’s calculate what you’re truly foregoing… A 25% savings on the above averages is $687. If you’re paying more, you could be saving more!

The Multi-Policy Discount is the largest discount available. Other discounts such as Good Driver, Occupational, and others are good, but if your home and auto insurance are not with the same company, you’re almost certainly leaving money on the table.

Choosing an independent, local agent helps ensure you’re adequately protecting your assets and your family. At Old Harbor, we want to get to know you so that you have the coverage you need. Unfortunately, it’s all too common we meet individuals that have sizeable assets, yet their online auto insurer is unaware, and is all too willing to sell them a “low-cost” [Read: Low Coverage] policy.

We would welcome the opportunity to help you maximize your insurance savings and become your trusted insurance advisors. Contact Us today to see how we can save you on your premiums and help secure your financial future!

DISCLAIMER: This article is provided for general informational purposes only and should not be relied upon for legal advice. Old Harbor Insurance Services, LLC recommends you consult your risk manager, attorney, business advisor, or insurance representative for all questions or concerns.

Sources:

*Based off 2013 NAIC Homeowners Study

**https://www.insure.com/car-insurance/car-insurance-rates.html

https://smartasset.com/retirement/average-retirement-age-in-every-state