What do you do when an unfortunate event occurs, such as a violent thunderstorm damaging your house or a burglar breaking into your home?

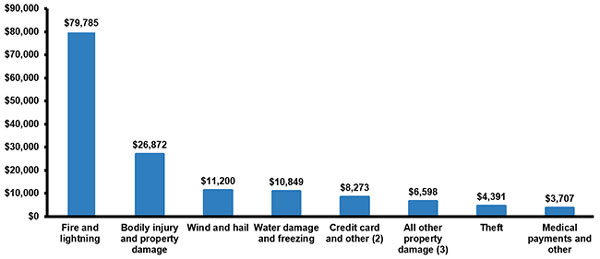

Data from the Insurance Information Institute (I.I.I.) shows that fire/lightning has the highest claims severity in the U.S., causing homeowners an average claim of $79,765, while medical payment comes last with an average loss of $3,707.

Initiate a homeowners insurance claim process – and do so quickly!

Home insurance helps to reimburse you whenever your home or property is damaged, stolen, destroyed by a known peril that is covered by your insurance policy. However, to make use of this coverage, you will have to file a home insurance claim.

If you are new to negotiating an insurance claims process, you’re in luck. This guide simplifies the complex insurance claims process and ensures that you enjoy the benefits of having the best homeowners insurance policy in California and its environs.

Here’s what you can expect from this comprehensive guide:

- How to report your claim in 9 easy steps.

- How to quickly get full payment for your claim.

- Who is the insurance claim check paid to?

- Is there a deadline for making claims and getting paid?

- Is it legal to handle your home insurance repairs yourself?

- What to do when there is money left over from your homeowners insurance claim.

- Who can you trust to get your claim payments processed as quickly as possible?

How to Report Your Claim in 9 Easy Steps

Are you faced with an unfortunate event that has destroyed or damaged your home?

Here are 9 steps you can follow to file a homeowners insurance claim successfully:

1. Report crimes to the Police

If your home has been burglarized or vandalized, or you have been the victim of theft, report the crime to the Police. You will receive a Police report which will include the names of all the law enforcement officers you speak with. You have to provide your insurer with all the details of the crime.

2. Call your insurance agency immediately

When you call your insurance agency, be sure to ask the following questions:

- Am I covered?

- How long do I have to file a claim?

- Do I need estimates for structural damage repairs?

- Will my claim be more than my deductible? (It may be unnecessary to go through the process of filing the claims if your loss is less than your deductible.)

- How long will it take for my claim to be processed?

3. Fill out your claim forms as quickly as possible

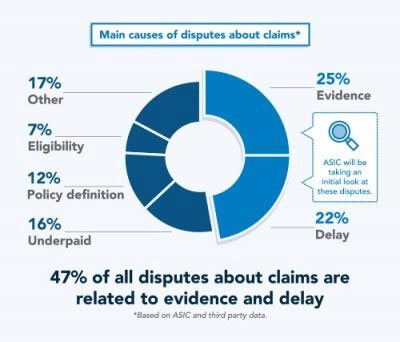

When you are sure that you need to file a claim, your insurance agency will send you all the necessary forms. According to the law, these must be sent to you within a specified period. Fill out the forms properly and return them as quickly as possible to avoid delays. Combined, providing evidence and delays account for 47% of all claim disputes.

4. Make sure your insurance adjuster inspects the damage

Your insurance agency is likely to arrange for an adjuster to come to your home and inspect the level of damage.

But who is an adjuster?

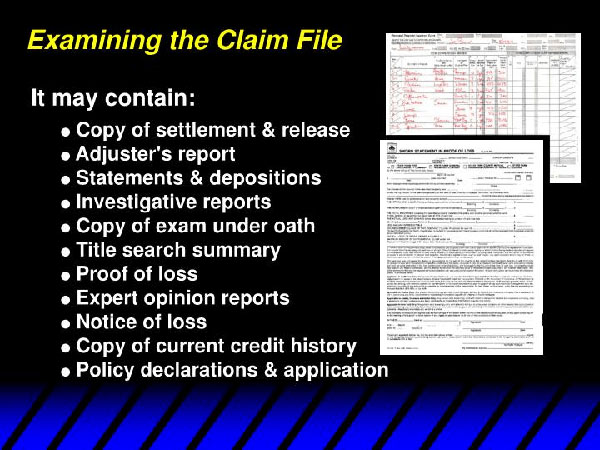

An adjuster can best be described as someone, usually your insurance agency’s representative, who visits your home to interview you and inspect the property damage. Afterward, they will determine how much your insurance agency should pay for the loss. All this is part of the adjustment process.

What is this Adjustment Process all about?

One of the things your insurance agency will do before compensating you for the damage to your property is to send out an adjuster. This is done when you file the initial claim.

The agency will typically send you an initial check at this point, enabling you to start hiring contractors while the agency continues processing the remaining part of your claim.

The evaluation of the adjuster and their review is considered authoritative. Therefore, the funding you get from your insurance agency depends on the adjuster’s evaluation of the damage.

5. Prepare for the visit of the insurance adjuster

Do not be unprepared when meeting the insurance adjuster. Show them all the structural damage to your home. Compile a comprehensive list of damaged items to save time.

6. Keep all the damaged items

If possible, take a video or photograph of the damage as soon as you can and take all the necessary steps to prevent further damage to your property. Do not throw out the damaged items until after the insurance adjuster’s visit.

If you spent money on trying to repair the damaged property or protect it from further damage, you need to save the receipts of the expenditure, so that you can send them to your insurance agency and get reimbursed later.

7. Take a home inventory of all damaged or lost items

Do you want to speed up the claims process?

One way to do this is by substantiating your loss, ensuring that everything is covered. Make a list of all the items that were either damaged or destroyed, calculate the value of your possessions, and give the list to your adjuster when they visit your home.

Also, make sure you have all the copies of receipts from your damaged or lost items available.

8. If you relocate, keep all receipts and records

If your home is so damaged that it is impossible to live in it, you may need to find somewhere else to stay in the meantime. Keep receipts and papers of all the additional expenses you incur.

Many homeowners insurance policies cover additional living expenses for situations like this but will require you to provide evidence of the additional costs.

9. Ask questions

Is there anything you do not understand about the claim filing laws in your region?

Ask questions. You can call your insurance agency or your state’s department of insurance. Asking questions will ensure that your process of filing the claim proceeds as smoothly as possible.

An expert insurance agency like Old Harbor Insurance Service will ensure that your claims will be filed quickly and that you will receive payment promptly after you have agreed on a settlement.

How To Quickly Get Full Payment For Your Claim

Do you want to get full payment for your claim as quickly as possible?

The best way to do this is by staying on top of what your insurance agency needs before issuing your payment.

Ask your insurance agency about their procedure and follow up regularly to ensure that your adjuster gets all the info and nothing is left out.

Who Is the Insurance Claim Check Paid To?

The process of negotiating your insurance claims also involves determining how and when the contractors will be paid to fix your home. You will have to make specific financial arrangements with your insurance agent to determine if compensation for the damages will be paid to you or your mortgage lender.

Why is it important to know where your funds will go?

With this knowledge, you can establish a workable timeline for when your home will be fixed.

Your insurance agency can choose to issue a check to the contractors but they often prefer to pay it to you or your mortgage lender.

So, who gets the check from the insurance agency?

1. The homeowner

If you are the sole owner of the house that was damaged, robbed, or destroyed, you will receive the claim check. This also applies to the personal contents of your home.

2. The mortgage lenders

If you have a mortgage on your home at the time of the incident, your insurance agency will likely issue the checks to both you and the mortgage lenders.

Why does the insurance agency do this?

The reason is that the mortgage lender already has a vested interest in making sure your home is in good condition. Hence, they would want to choose what repairs are needed for your home and see to it that the repairs are carried out.

Sometimes, mortgage lenders place funds received from the insurance agency in escrow until they get information about the designated contractor and the work that needs to be done on the home.

3. The contractors

An insurance agency may also decide to pay the contractor in charge of the repairs directly instead of transferring money for the repairs to you, the homeowner. This is usually done at the contractor’s request.

To do this, the contractor will have to give you a “Direction to Pay” Form. This document is contractual in nature and, therefore, you have to take your time to review it thoroughly. Do not fill out the form until you are certain that payment terms align with your interests.

4. The condominium or coop management company

If you have coop or condo insurance, the check may be issued to the condominium or coop management company in some instances.

Is There a Deadline for Filing Claims and Getting Paid?

Every insurance agency has timelines for eligible claims to be lodged Do not neglect to ask your insurance claims adjuster for details about this. Try as much as possible not to miss deadlines, otherwise you will have to pay out of pocket.

Is It Legal To Handle Your Home Insurance Repairs Yourself?

Sometimes, the damage done to your home may be too expensive to fix, even after your homeowners’ insurance already covers some of the damage cost. This can make claiming and performing the repairs yourself look very enticing.

But what’s the guarantee that doing this will save a lot of money, even if you can do the repairs yourself?

Whether or not you do your own home insurance repairs is largely your insurance agency’s call to make. After all, it is your insurer who gets to decide how much to pay and when they will pay.

So, even if the insurers allow you to do the work yourself, they will want to supervise you. The amount of supervision will depend on the insurer’s policies and the complexity of the damage done to your home.

Also, if the work does not require a lot of skill, the insurer is more likely to allow you to do the repairs yourself. Examples of work that requires relatively little skill are cleaning up debris, replacing picture frames, etc.

On the other hand, your insurers may not allow you to do your home repairs yourself if a more technical skill is required. This applies to things like plumbing, electrical work, etc.

Your city may decide to give you a permit to do your repairs yourself depending on the severity of the damage to your home and the laws of the city you live in.

But do you have the license required to do specific repairs?

If the repairs require electrical work, your city may only allow a licensed electrician to do it. If you are not able to get these approvals, it may be illegal for you to do the repairs yourself.

Find out from your local development services or department of buildings what type of permission you need to do your own repairs.

What To Do When There Is Money Left Over From Your Homeowners Insurance Claim

Is it possible that some money will be leftover from your homeowner’s insurance claim?

Yeah! It is possible to have some extra money left over. This could be either because you got your contractor under-budget or you saved some money after doing most of the work yourself.

So, what do you do when you find out you have some extra money left over?

Well, any money you end up with is yours as long as you didn’t lie or cheat to get it and the insurance agency doesn’t ask about it.

Be that as it may, here are some of the things you should do when you realize there is some of the claim money left over:

- First, you need to go over your homeowner’s insurance policy. Check for specific provisions regarding what would happen if there is leftover claim money.

- Be completely honest with your insurer. If you lie and tell your insurance agency that there is no money left over, or you paid the bills sent to the insurer, it is considered insurance fraud.

Insurance fraud is a serious crime, and you could be prosecuted, face jail time, or be fined if you are caught.

Additionally, if you are caught committing insurance fraud, your policy may be canceled and other insurance agencies could blacklist you, preventing you from buying any other insurance policies.

Who Can You Trust to Get Your Claim Payments Processed As Quickly As Possible?

When you are done with your claim, you will likely sign a notice indicating the total amount that you will be paid. This document will show that the claim is closed and that you accept the final payment.

If you haven’t reached that point, track your claims checks and expenses to ensure you are paid fully until the final payment is made.

Are you in California or the neighboring regions? Contact Old Harbor Insurance Services today to get your claim payments processed as quickly as possible.