Receiving a non-renewal notice from Western Mutual feels like a personal rejection, but you’re experiencing something far more widespread in California’s insurance crisis. Western Mutual has recently tightened underwriting standards, citing maintenance issues, debris accumulation, or failure to provide proof of repairs—and thousands of California homeowners are in the same position. The reality is that major carriers have largely exited California, making coverage harder to find than ever before.

Here’s what gives you hope: California law requires 90-day notice before non-renewal, and that window is your opportunity. You have more coverage options than you realize, and working with an independent agent like Old Harbor Insurance gives you access to carriers most homeowners never discover. By the end of this guide, you’ll know exactly how to respond and where to find competitive coverage even after Western Mutual has dropped you.

Understanding Western Mutual’s Non-Renewal Decisions

Western Mutual operates in multiple states, but California presents unique challenges. The company uses third-party exterior inspections, and consumer complaints show non-renewals often stem from maintenance issues, debris, unsanitary conditions, or missing repair documentation. According to the California Department of Insurance, inspection standards vary by insurer, which is why one carrier may decline a property that another will insure.

It’s important to distinguish non-renewal from cancellation. Non-renewal simply means coverage won’t continue at expiration, giving you time to plan and secure alternatives. You’re not facing an immediate loss of coverage—you’re navigating a transition, with options still available.

Why California’s Insurance Market Has Collapsed

California’s insurance crisis isn’t about individual homeowners. It’s about systemic market failure. State Farm, Allstate, and Farmers have all stopped issuing new policies in California. The 2025 Los Angeles fires alone triggered an estimated $40 billion in losses, accelerating carrier exits. Meanwhile, Proposition 103 limits how insurers can adjust premiums, making profitability nearly impossible when wildfire claims skyrocket.

Just 12 insurers now collect 85% of California’s premiums, while smaller regional carriers like Western Mutual freeze or withdraw new business. This isn’t about poor property maintenance—it’s driven by regulatory pressure and wildfire risk. For homeowners, the takeaway is clear: act immediately after a non-renewal notice, as even brief coverage gaps can trigger costly force-placed insurance from your lender.

Your Immediate Action Plan After Western Mutual Drops You

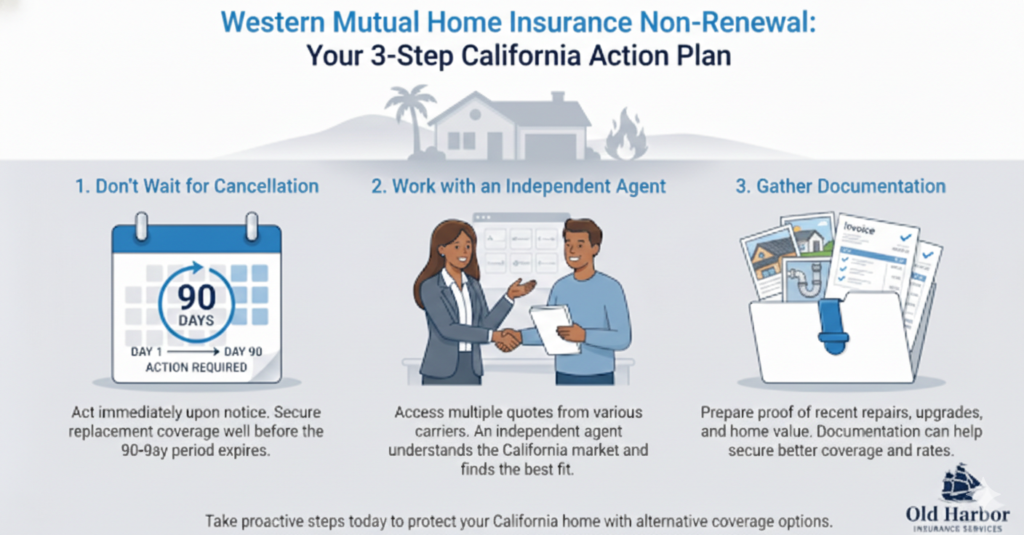

Step 1: Don’t Wait for Cancellation to Take Effect

The moment you receive a non-renewal notice, contact an independent insurance broker. Don’t assume you’ll handle it later. California’s 90-day notice requirement feels like plenty of time until you realize how quickly it evaporates, especially for properties carriers consider high-risk.

Step 2: Work with an Independent Agent

This is where independent agents like Old Harbor Insurance become invaluable. Unlike online quote services that access only a handful of carriers, independent agents work with both admitted carriers (regulated by California’s Department of Insurance) and surplus line carriers (non-admitted specialists for high-risk properties). When Western Mutual drops you, Old Harbor can access carriers and coverage options you couldn’t find independently.

Step 3: Gather Documentation

Prepare proof of any home repairs, improvements, or maintenance. If Western Mutual cited specific issues—roof damage, debris, drainage problems—get them documented with photos and contractor invoices. This documentation becomes your leverage with new carriers, demonstrating you’re not ignoring maintenance. It’s the difference between competitive rates and rejection.

Alternative Carriers Now Accepting California Homeowners

Several carriers continue to insure California properties despite market-wide contraction. Amica Mutual consistently ranks as California’s highest-rated homeowner insurer. USAA offers superior ratings for military and military-connected families. Travelers maintains A++ financial strength and strong customer service. Mercury Insurance specializes in California with competitive rates and wildfire discounts. Progressive offers statewide coverage with specialty earthquake and wildfire options.

The critical advantage of working with Old Harbor Insurance is that your agent knows which carriers currently accept your risk profile. Online quote systems don’t. Your agent connects you with realistic options rather than wasting your time on carriers that will ultimately reject you.

Coverage Options When Traditional Carriers Say No

When standard carriers decline coverage, California’s FAIR Plan (Fair Access to Insurance Requirements) becomes a last-resort option. The FAIR Plan is a state-run program that provides basic fire and wildfire coverage for homeowners denied by private insurers, with dwelling limits up to $3 million. Coverage is narrower, and deductibles are higher than standard policies, but it prevents you from being uninsured.

Using FAIR Plan Coverage Strategically

FAIR Plan policies are best viewed as temporary protection while you improve your home’s insurability. Premiums typically run 20–40% higher due to elevated risk, but they offer a critical bridge when other options aren’t available.

Surplus Line Carriers for High-Risk Properties

Surplus line carriers—non-admitted insurers that specialize in higher-risk homes—offer another alternative. These insurers operate outside standard rate regulations, allowing them to cover properties traditional carriers won’t. According to the California Department of Insurance, surplus line policies are legitimate and regulated, though they do not include state guaranty fund protection.

Separate Coverage for Earthquake and Flood

Earthquake and flood insurance must always be purchased separately in California. These coverages are never included in standard homeowners policies, regardless of carrier, and should be addressed independently when replacing coverage.

Improving Your Insurability and Securing Better Rates

Improving your home’s insurability can reduce non-renewal risk and lower premiums. Defensible space, fire-resistant Class A roofing, and updated electrical or plumbing systems signal lower wildfire and loss exposure. Monitored alarms and clear maintenance records further demonstrate responsible ownership.

Higher deductibles can significantly cut premiums, and bundling home and auto policies often unlocks additional discounts—something independent agents like Old Harbor help optimize. Document all improvements with photos, invoices, and permits; strong documentation shifts inspections from risk concerns to confidence in how the property is maintained.

Avoiding Future Non-Renewals

Once you’ve secured replacement coverage, maintain it through consistent property management. Schedule annual roof inspections and address issues immediately. Keep gutters clear, maintain defensible space, and respond promptly to any carrier inspection reports. File claims only for major losses—frequent small claims flag you as high-risk and trigger non-renewal attention.

Communication matters too. When your insurer requests documentation or repair proof, respond quickly and thoroughly. Many non-renewals stem from communication gaps where homeowners delay responding, leaving carriers questioning whether repairs were actually completed. According to industry research, responsive homeowners experience fewer non-renewals than those who go silent when contacted.

Stay informed about your policy and market changes. Annual reviews with your independent agent catch coverage gaps early and keep you aware of rate changes in the market.

Your Path Forward Starts Today

Being dropped by Western Mutual feels isolating, but it’s a widespread California reality—not a reflection of your worth as a homeowner. What matters now is acting decisively. California’s insurance market is constrained, but coverage still exists through carriers most homeowners never discover.

Old Harbor Insurance has guided thousands of California homeowners through this transition. As independent agents, they offer access to admitted carriers, surplus line specialists, and emerging options in California’s evolving market. Contact Old Harbor Insurance at (951) 297-9740, email info@oldharbor.com, or visit their Temecula office at 43015 Blackdeer Loop, Suite 201. Your replacement coverage isn’t just possible—it’s waiting for your next step.

FAQs

What should I do immediately after receiving a Western Mutual non-renewal notice?

Contact an independent broker like Old Harbor at (951) 297-9740 immediately. Don’t wait. California’s 90-day notice requirement gives you time, but acting quickly prevents coverage gaps and lets you compare multiple carriers thoroughly before your policy expires.

Can I appeal Western Mutual’s non-renewal decision?

Yes. File a complaint with the California Department of Insurance at 1-800-927-HELP if you believe the non-renewal is unjustified. Western Mutual must provide written reasons for non-renewal. Review the letter carefully and gather documentation supporting an appeal if applicable.

Will alternative carriers charge higher premiums?

Not necessarily. While FAIR Plans and high-risk carriers often carry higher premiums, Mercury, Progressive, and AAA offer competitive California rates. Independent agents compare multiple options to find the best coverage and cost combination for your specific situation.

What if I’m in a wildfire-prone area?

Wildfire risk is a primary non-renewal driver. Focus on defensible space, fire-resistant roofing, and updated home systems. Mercury, Travelers, and surplus line carriers specialize in wildfire-prone properties. The California FAIR Plan includes wildfire coverage. Earthquake and flood insurance purchase separately.

How long does approval take with a new carrier?

Standard carriers typically approve applications within 7-10 business days. Online carriers like Lemonade sometimes offer minutes-to-approval. High-risk properties requiring inspections may need 2-4 weeks. Work with your agent to expedite if your coverage is expiring soon.

Is the California FAIR Plan a permanent solution?

No. FAIR Plans are last-resort safety nets, not long-term solutions. Premiums run 20-40% higher than standard policies with limited coverage. Use your time on a FAIR Plan to improve your home’s insurability and transition to a standard carrier when possible.

How do exterior inspections affect my coverage?

Carriers use inspections to assess maintenance standards and loss exposure. Issues like debris, roof damage, poor drainage, or overgrown vegetation trigger non-renewals. Address repairs immediately after inspection reports and document completion before renewal decisions are made.

What’s the difference between admitted and surplus line carriers?

Admitted carriers follow strict California Department of Insurance regulations. Surplus line carriers operate outside these rules and insure higher-risk properties that standard carriers reject. Surplus line policies may offer broader coverage but less state regulation. Independent brokers access both.

Can I get coverage after multiple rejections?

Yes. After two or more denials, you qualify automatically for California’s FAIR Plan. Surplus line carriers also specialize in repeatedly denied applicants. Agents like Old Harbor with access to specialty markets match hard-to-place properties with carriers accepting their risk profile.

How can I lower premiums while maintaining adequate coverage?

Bundle discounts, increase deductibles, invest in home improvements, maintain claim-free records, install monitored security systems, and work with independent brokers identifying carrier-specific discounts and rate advantages.