If you own a home in Orange County, your insurance should reflect its real value. Many homeowners keep inherited policies without realizing they’re overpaying or underprotected. This guide explains key local risks, why generic policies fall short, and how Old Harbor Insurance helps tailor coverage to Orange County homes.

Here’s what might surprise you: the most expensive home insurance policy isn’t always the one with the best protection. In fact, Orange County homeowners often pay premium prices for coverage that leaves critical gaps untouched. Ready to understand what real home insurance protection actually looks like in Orange County? Let’s dive in.

Understanding Orange County’s Unique Housing Market

Orange County’s housing market is highly diverse, from beachfront estates to older neighborhood homes and newer inland developments. That variety means insurance needs can differ dramatically—even between neighbors. Yet many insurers still rely on one-size-fits-all policies, despite the very different risks faced by a $1.2 million home in Newport Beach versus a $750,000 property in Santa Ana.

According to the National Association of Insurance Commissioners (NAIC), property values and local risk factors should heavily influence coverage decisions. In Orange County specifically, your home’s age, construction type, distance from the coast, and proximity to wildfire zones all impact both your premiums and your coverage needs. Understanding these factors isn’t just about saving money—it’s about making sure you’re actually protected if something goes wrong.

The Real Cost of Underinsurance in Orange County

One of the biggest mistakes Orange County homeowners make is assuming their policy limits automatically match their home’s replacement value. They don’t. According to the Insurance Information Institute (III), the average homeowner is underinsured by 20-30%, meaning when disaster strikes, they’re left covering thousands out of pocket. In Orange County’s expensive real estate market, that gap translates to tens of thousands of dollars.

Imagine your home is worth $900,000, but your policy only includes $650,000 in dwelling coverage. A major fire causes $750,000 in damage. Insurance pays $650,000, leaving you responsible for the remaining $100,000—plus temporary living expenses during repairs. This happens to Orange County homeowners every year, often because no one reviewed their coverage against the true replacement cost.

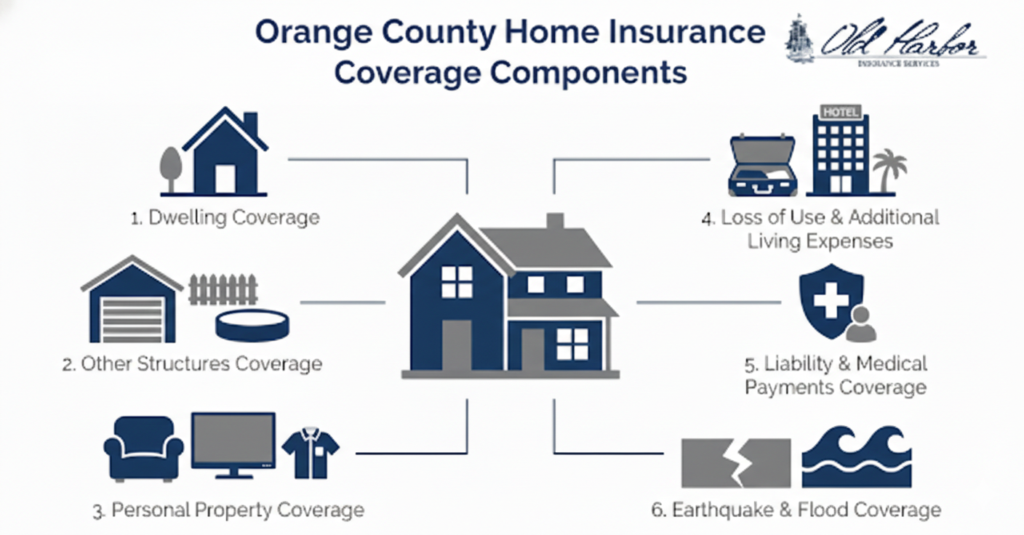

Home Insurance Coverage Components You Need to Know

Most people think home insurance is just about the structure of the house, but comprehensive coverage includes multiple layers of protection. Understanding what each component covers helps you spot gaps in your current policy.

Dwelling Coverage

Dwelling coverage protects the physical structure of your home, including the walls, roof, foundation, and attached structures like garages or decks. This coverage should reflect your home’s true replacement cost—not just its market value.

Other Structures Coverage

Other structures coverage applies to detached buildings on your property, such as guest houses, sheds, pool houses, fences, or detached garages. These structures are often overlooked but can be expensive to repair or rebuild.

Personal Property Coverage

Personal property coverage protects your belongings inside the home, including furniture, electronics, clothing, and other possessions. Many homeowners underestimate the total value of what they own, which can lead to inadequate coverage limits if a major loss occurs.

Loss of Use & Additional Living Expenses

This coverage pays for hotel stays, meals, and other temporary living expenses if your home becomes uninhabitable due to a covered loss. Without sufficient limits, these costs can add up quickly during extended repairs.

Liability & Medical Payments Coverage

Liability coverage protects you if someone is injured on your property and files a lawsuit, while medical payments coverage helps cover minor injuries regardless of fault. In a high-cost, highly litigious area like Orange County, relying on a basic $100,000 liability limit can expose homeowners to significant financial risk.

Earthquake and Flood Coverage: Critical Add-Ons for Orange County

Here’s a conversation Orange County residents need to have with their insurance agent but often don’t: standard home insurance doesn’t cover earthquake or flood damage. These aren’t small gaps—they’re massive exposures for a state that experiences both threats regularly.

Earthquake Risk in Orange County

The U.S. Geological Survey ranks California as the highest earthquake-risk state, with Orange County in an especially active area. Damage can range from minor cracks to major structural failure, with moderate events costing $50,000 or more. Standard homeowners insurance doesn’t cover this—earthquake coverage requires a separate policy.

Flood Risk and Urban Flooding Exposure

Flood risk is equally serious, especially for homes near the coast, in flood zones identified by FEMA, or in areas prone to urban flooding during heavy rain. According to FEMA’s National Flood Insurance Program (NFIP), one inch of flooding in an average home costs approximately $27,000 in damages. Orange County experiences occasional severe flooding, particularly in certain neighborhoods, yet most homeowners assume their standard coverage handles it. It doesn’t.

Why Independent Agents Get Orange County Home Insurance Right

The difference between Old Harbor Insurance and captive agents at national carriers comes down to choice. Captive agents can only sell their company’s policies, which limits their ability to tailor coverage for Orange County’s unique risks and diverse housing market.

Independent agents at Old Harbor work with 81 insurance carriers, allowing us to compare options and match coverage to your specific home, location, and risk profile. This flexibility matters in an expensive market like Orange County, where a $500,000 Irvine condo requires a very different insurance strategy than a $2 million Crystal Cove estate—and we treat them accordingly.

How Old Harbor Insurance Helps Orange County Homeowners

Our approach to Orange County home insurance starts with understanding your real situation—not just filling out a form. We take the time to learn about your home’s age, construction, proximity to fire-prone areas, valuable items requiring special coverage, rental use, and other factors that shape your actual insurance needs. From there, we explain what comprehensive coverage looks like for your specific situation.

We work exclusively with A-rated carriers to ensure your coverage is backed by financially stable companies—an important factor in California’s challenging insurance market. We also provide claims guidance, so you’re never navigating the process alone. For Orange County homeowners seeking coverage tailored to their home, neighborhood, and assets—not a generic policy—this personalized approach makes the difference.

Protect Your Family’s Biggest Investment Today

Your home is likely the largest investment you’ll ever make. It deserves protection that actually reflects its value and covers the unique risks in your Orange County neighborhood. Generic policies from national carriers built around customer volume, not customer care, often fall dangerously short.

Ready to talk about home coverage that actually makes sense? Call us at (951) 297-9740, email info@oldharbor.com, or get a quote online in just a few minutes. One of our licensed agents will contact you within 24 hours to discuss your specific situation—no pressure, no obligation. Let’s make sure you’re genuinely protected.

FAQs

What does standard Orange County home insurance actually cover?

Standard homeowners coverage includes dwelling protection (your home’s structure), personal property (your belongings), liability (protection if someone is injured on your property), and medical payments coverage. It does not cover earthquake, flood, or routine maintenance issues. You need to add these separately or confirm they’re excluded from your policy.

How much dwelling coverage do I actually need in Orange County?

Enough to fully rebuild your home if it’s destroyed—not its current market value, which includes land, but the replacement cost of the structure. In Orange County’s expensive market, this often surprises homeowners. We recommend getting a professional replacement cost analysis from your agent to ensure you’re covered adequately.

Is earthquake insurance really necessary in Orange County?

Given California’s seismic activity and Orange County’s location, yes—especially if you own an older home with unreinforced masonry or if earthquake damage could financially devastate you. Even newer homes aren’t immune to damage. The cost is often surprisingly reasonable compared to the protection it provides.

Do I need flood insurance if I’m not in an official flood zone?

Not all flooding happens in designated flood zones. Heavy rains, poor drainage, and urban flooding can damage homes outside official zones. Many Orange County homeowners have experienced flooding surprises. If you’re uncertain, talk with your agent about your specific risk level.

What’s the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays what it costs to replace your damaged items with new ones. Actual cash value (ACV) pays replacement cost minus depreciation, which is always less. For personal property, replacement cost is almost always worth the modest premium increase.

Why do some Orange County homes cost more to insure than others?

Multiple factors: home age, construction materials, proximity to coast (salt damage), distance from fire-prone areas, claims history, credit score (used for pricing), and local crime rates. A 1960s home near fire zones will cost more to insure than a new home in a safer area, even if they’re similar sizes.

Should I bundle my home and auto insurance with Old Harbor?

Bundling typically saves 10-15% on premiums. However, the real benefit is having one agent who understands all your coverage and can coordinate your protection strategy across policies. We handle everything, so when your circumstances change, all your coverage updates accordingly.