Most Orange County homeowners don’t review their insurance until a loss reveals coverage gaps. Insurance here isn’t like other markets—zip code, home age, wildfire risk, and coastal exposure all affect cost and protection. Drawing on years of local experience, Old Harbor Insurance helps homeowners evaluate their coverage, understand what truly drives their rates, and avoid overpaying, while explaining why premiums can vary widely even on the same street.

So what’s the biggest insight local agents at Old Harbor Insurance want homeowners to know before choosing a policy? The cheapest quote isn’t the best deal if it leaves you exposed. Let’s break down what real homeowners insurance looks like in Orange County.

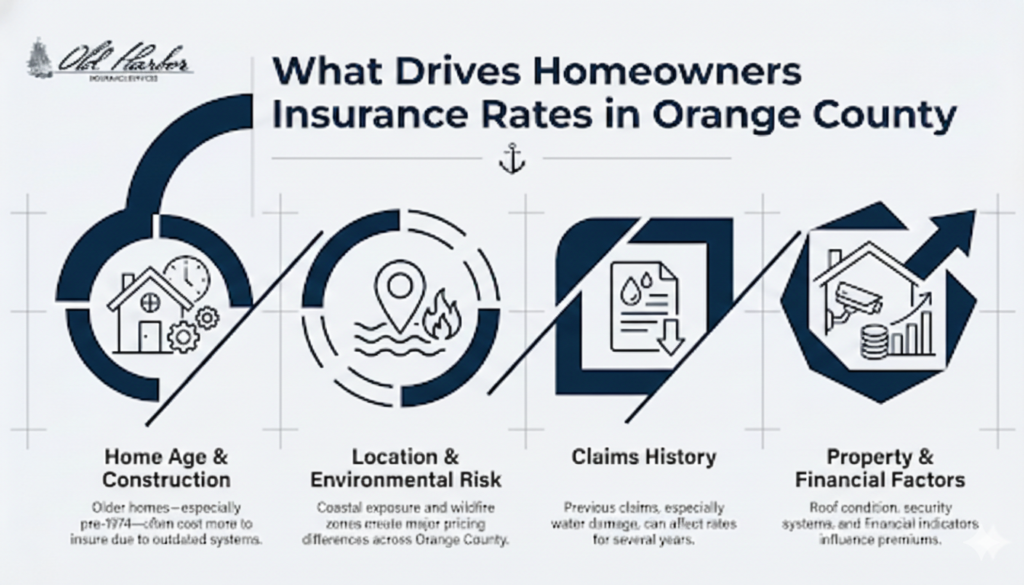

What Actually Drives Your Orange County Homeowners Insurance Rates

Your premium is based on specific risk factors insurers use to predict loss. Understanding them explains why your rate looks the way it does—and where savings may be possible.

Home Age and Construction

Homes built before 1974 often carry higher premiums due to outdated wiring, plumbing, and roofing. Even well-maintained 1960s homes can cost 30–50% more to insure than newer builds nearby.

Location and Environmental Risk

Rates vary by location within Orange County. Coastal homes face salt and storm exposure, while inland properties near wildfire areas face different risks. According to the California Department of Insurance, proximity to designated fire hazard zones can significantly increase premiums, and the state provides public maps homeowners can use to assess their risk.

Claims History and Financial Factors

Past claims—especially water damage—can affect rates for years. Credit score, roof condition, security systems, and heating type also factor into pricing. Knowing these variables helps homeowners identify opportunities to reduce costs without sacrificing coverage.

The Gap Between What Homeowners Think They Have and What They Actually Have

Most Orange County homeowners have never fully reviewed their insurance coverage. They assume their agent explained everything or skimmed the policy once and moved on—creating a risky gap between what they think is covered and what actually is. This misunderstanding often goes unnoticed until a loss exposes it.

According to the National Association of Insurance Commissioners (NAIC), the average homeowner misunderstands at least one major part of their policy. Common assumptions—like coverage automatically adjusting for inflation or protecting certain types of water damage or off-premises theft—are often wrong. In Orange County’s high-value housing market, even a $50,000 coverage gap can be catastrophic, which is why a detailed policy review is essential before—not after—a loss occurs.

Coverage Options Beyond the Basic Package

Many insurers rely on “standard” packages, even though Orange County homes vary widely in value and risk. A $600,000 home shouldn’t be insured the same way as a $1.8 million property—yet basic policies often treat them similarly.

Agreed Value Coverage

Agreed value coverage sets your rebuild amount upfront. In a total loss, you receive that full amount without disputes, making it especially valuable for custom or high-end homes.

Higher Liability Limits

Homes with pools, guest houses, or frequent visitors benefit from increased liability coverage. According to the Insurance Information Institute (III), homeowners with significant assets face greater exposure to lawsuits, and standard $100,000–$300,000 limits are often insufficient in California.

Replacement Cost for Personal Property

Replacement cost coverage pays for new items, while actual cash value deducts depreciation. The premium difference is usually small, but the claims payout difference can be substantial.

Why Orange County Requires Year-Round Insurance Attention

Unlike more stable insurance markets, Orange County homeowners face risks that change with the seasons. Wildfire exposure peaks in late summer and fall, while rainy months bring increased flood and water intrusion risk—especially in areas with drainage or flood-zone concerns. These seasonal shifts make ongoing policy attention essential.

Insurance availability and pricing also change as carriers adjust underwriting. According to the California Department of Insurance, many insurers have raised rates or reduced coverage in high-risk areas, meaning a good policy from a few years ago may no longer be competitive—or available. Annual reviews help account for these shifts, along with property changes like new roofs, pools, or landscaping that can affect both risk and cost.

How Orange County Homeowners Reduce Rates Without Sacrificing Protection

Lowering your homeowners insurance costs doesn’t mean cutting coverage—it means reducing risk in ways insurers actually reward.

Home Improvements That Earn Discounts

Installing a monitored security system can reduce premiums by 10–15%. Roof repairs or replacements with updated materials often qualify for 10–20% discounts. Bundling home and auto insurance typically saves 10–15% and helps ensure coverage is properly coordinated.

Discounts Many Homeowners Miss

Some carriers offer loyalty discounts for claim-free history or savings for paying premiums annually instead of monthly. According to the National Association of Insurance Commissioners (NAIC), many homeowners never ask about available discounts, missing easy opportunities to lower costs.

Using Deductibles Strategically

Raising your deductible can reduce premiums—for example, increasing it from $500 to $1,000 may save $200–300 per year. This can make sense if you have savings to cover it, but it’s important not to raise it beyond what you could comfortably afford after a loss.

How Old Harbor Insurance Approaches Orange County Coverage

Our strategy with Orange County homeowners starts with listening—genuinely understanding your home, your neighborhood, your assets, and your concerns. We don’t hand you a standard package and call it done. We walk through your specific exposure, explain what comprehensive coverage actually looks like for your situation, and help you understand where gaps might exist in your current policy.

We work with multiple carriers, so if your insurer raises rates or limits coverage, we can often find better options. Instead of automatically renewing your policy, we shop it annually to keep rates competitive and coverage aligned with your needs. For Orange County homeowners facing rate shock or unexpected changes, this proactive approach makes a real difference.

Get Clarity on Your Orange County Coverage Today

Your home is your sanctuary and your investment. It deserves insurance protection that’s actually tailored to Orange County’s unique risks and your family’s specific needs—not a one-size-fits-all template from a carrier optimizing for volume over care.

Ready to get a clear picture of your current coverage and explore whether you’re getting the best rates? Call us at (951) 297-9740, email info@oldharbor.com, or fill out a quick quote form on our website. One of our licensed agents will contact you within 24 hours to review your situation and discuss options. No pressure, no surprise fees—just straightforward guidance from someone who actually knows the Orange County market.

FAQs

Why does my Orange County homeowners insurance rate differ so much from my friend’s who lives two blocks away?

Multiple factors vary by neighborhood even within zip codes: fire zone proximity, flood risk, crime rates, and even the specific insurance company you use can create significant price differences. Two homes that look identical might have different roof ages, electrical systems, or water sources (well versus city water), all of which affect rates. Get a detailed quote breakdown to understand your specific factors.

Should I increase my deductible to lower my premium?

It depends on your financial situation. Increasing from $500 to $2,500 can save you $400-600 annually, but only do this if you genuinely have that deductible amount in savings. If a loss occurs and you can’t pay your deductible, you’re stuck. Balance premium savings against your emergency fund capacity.

What’s the difference between homeowners insurance and home warranty?

Homeowners insurance covers sudden, accidental damage like theft, fire, or weather events. Home warranty covers mechanical failures of systems like HVAC, plumbing, or appliances—things that wear out over time. Most homes need both. They protect against different types of problems.

How often should I review my homeowners insurance policy?

At minimum, annually—especially before wildfire season and before rainy season. Also review whenever you make home improvements, add structures, install security systems, or make changes that affect your home’s value or risk profile. Life changes also warrant reviews.

Can I get homeowners insurance if my home has had multiple claims?

Yes, but you’ll likely pay higher premiums or face limited carrier options. Some carriers won’t insure homes with three or more claims in five years. If you’re in this situation, an independent agent can help you navigate the market and find carriers willing to work with you.

Does my homeowners insurance cover water damage from a burst pipe?

It depends on your specific policy. Sudden, accidental water damage from a burst pipe is usually covered under homeowners insurance. Water damage from poor maintenance, gradual leaks, or flooding is not covered. Review your policy or ask your agent for specifics about what water damage is included.

What happens to my rates if I file a claim?

Most claims impact your rates for three to five years, with some carriers surcharging you for that period. Small claims sometimes have less impact than large ones. This is why understanding your deductible is important—sometimes paying out of pocket for minor damage costs less over time than filing a claim that will increase your premiums for years.

Is earthquake insurance worth getting in Orange County?

That’s a personal decision based on your financial situation and risk tolerance. The U.S. Geological Survey estimates California’s seismic risk is significant, and Orange County has experienced damaging earthquakes historically. Earthquake insurance is affordable (often $300-600 annually), but it’s optional. Talk with your agent about your specific property’s seismic risk and what you could afford to pay out of pocket if an earthquake occurred.