Newport Beach coastal homes face risks standard homeowners policies often overlook, including saltwater corrosion, ocean surge, and elevated liability exposure. A policy purchased years ago may leave you underprotected. Old Harbor Insurance has spent years helping Newport Beach homeowners close these coastal coverage gaps.

This guide explains where standard policies fall short and how to build coverage that matches true coastal risk. Coastal insurance isn’t about higher premiums—it’s about knowing what’s covered, what isn’t, and why location matters as much as square footage when protecting your home.

Understanding Coastal Risk in Newport Beach: Beyond the Basics

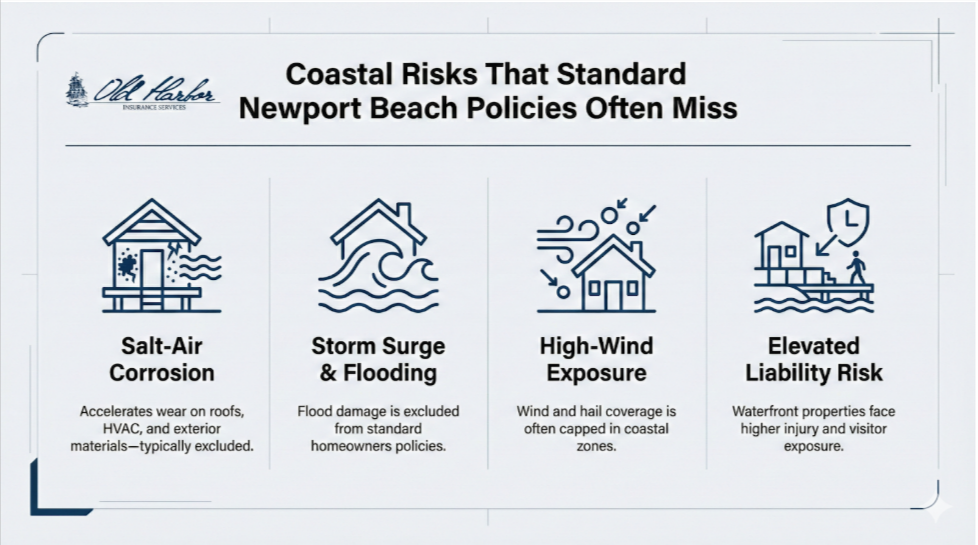

Your Newport Beach property faces a very different risk profile than homes just miles inland. Salt-air corrosion accelerates damage to roofing, HVAC systems, and exterior materials, while storm surge can compromise foundations and structural elements in ways standard policies often fail to cover.

Wind exposure adds another layer of risk. Santa Ana winds and severe coastal storms can cause major damage that many homeowners policies limit or exclude. According to the California Department of Insurance, Newport Beach sits in the highest-risk tier for coastal property perils—making it essential to work with an agent who knows which carriers still insure coastal homes and how coverage actually applies.

Sea-Level Rise and Long-Term Coastal Risk

What many Newport Beach homeowners don’t discuss with their agents is how sea-level rise affects insurance. Projections for Southern California show increases of 1–4 feet by 2100, accelerating coastal flood risk and influencing insurability, resale value, and lender requirements today.

As sea levels rise, properties now in moderate-risk zones may shift into high-risk zones within the next 20–30 years, potentially triggering mandatory flood insurance. Some insurers are already factoring climate-driven flood risk into premiums and coverage decisions, meaning a home that’s insurable today may face limits or higher costs in the future.

FEMA Flood Zones and What They Actually Mean for Your Property

Understanding your FEMA flood zone is critical—it determines whether flood insurance is required, how much it costs, and your actual risk. The City of Newport Beach provides access to FEMA Flood Insurance Rate Maps (FIRMs) so homeowners can identify their exact flood zone.

Special Flood Hazard Areas (SFHAs), including zones AE and VE, carry the highest risk. Zone AE covers areas subject to 100-year flooding, while zone VE designates coastal high-hazard areas with wave action and significantly higher insurance costs. Flood insurance is federally required in these zones for properties with federally regulated mortgages.

Why FEMA Flood Zones Don’t Tell the Whole Risk Story

Here’s the critical nuance: even properties in zones X (moderate-to-low risk) or outside mapped flood areas can experience significant flood damage from storm surge, extreme rain events, and drainage issues that FEMA maps don’t fully capture.

Research from the National Bureau of Economic Research demonstrates how FEMA flood zone designations significantly affect property values, insurance costs, and market perception of flood risk. Getting your exact flood zone right matters tremendously for both your insurance strategy and long-term asset value.

Standard Homeowners Coverage: The Coastal Gaps You Need to Know

Most standard homeowners policies cover dwelling, personal property, liability, and living expenses—but with limits that coastal homes expose quickly. In high-wind zones, wind and hail coverage is often capped at 5–10% of dwelling value, meaning a $500,000 home may only have $25,000–$50,000 in wind coverage. Flood damage is excluded entirely and requires separate flood insurance, while erosion is typically not covered at all.

What catches many Newport Beach homeowners off guard is assuming they’re fully insured. An $80,000 windstorm loss may result in only a $35,000 payout, and salt-air damage to HVAC systems is treated as wear-and-tear, not a covered claim. Understanding how your specific carrier handles claims matters long before you need to file one.

Coastal-Specific Coverage: Windstorm, Flood, and Earthquake

The solution to coastal coverage gaps isn’t panic—it’s strategic layering of specialized programs that address your actual exposure profile.

Windstorm and Hail Coverage

Windstorm/Hail Coverage removes the percentage cap most standard policies impose and provides comprehensive wind protection—essential in coastal Southern California where Santa Ana winds regularly exceed 60 mph. For properties with older roofing or higher-wind-exposure zones, this coverage becomes foundational.

Flood Insurance (NFIP)

Flood Insurance through the National Flood Insurance Program (NFIP) covers water damage from storm surge, heavy rain, and overflow. Established by Congress to allow property owners to purchase federal flood insurance, the NFIP is your mandatory option if you’re in an AE or VE zone. Even a 25-year-old home that’s never flooded can experience first-time flood damage during extreme weather, and without separate flood coverage, you’re completely unprotected.

Earthquake Coverage

Earthquake Coverage is a separate add-on in California that many homeowners skip but shouldn’t, especially in coastal areas. The California Earthquake Authority (CEA) offers earthquake policies with affordable premiums. While not required, they’re increasingly important for coastal properties where ground movement can trigger foundation shifts more easily than in bedrock-stable inland areas.

Why Umbrella Insurance Matters for Coastal Properties

Coastal property comes with elevated liability exposure that inland homeowners underestimate. You have increased foot traffic from neighbors, beach access, visitors, and service personnel. If someone is injured on your property—whether slipping on a wet deck or injured in your pool—your standard homeowners liability coverage caps out at $300,000-$500,000. In litigious California, that’s not nearly enough.

Umbrella insurance sits on top of your homeowners policy and kicks in when liability claims exceed those limits. For Newport Beach homeowners with valuable oceanfront properties, umbrella coverage typically starts at $1 million and costs remarkably little—often just $200-$350 annually. It’s essentially catastrophe insurance that protects your assets when the worst-case scenario happens, making it non-negotiable for waterfront properties.

How Old Harbor Insurance Helps Newport Beach Homeowners

Old Harbor Insurance specializes in coastal California homes, recognizing that Newport Beach insurance isn’t one-size-fits-all. We evaluate your property’s location, flood exposure, and exterior condition, then leverage our network of 81 carriers—including coastal specialists—to build coverage that matches real risk.

We focus on education before claims happen, explaining coverage in plain language and identifying gaps upfront. Whether you need enhanced wind protection, flood insurance, or higher liability limits, we help you make informed decisions with confidence.

Protect Your Newport Beach Home Today

Coastal homeownership is rewarding, but it requires insurance sophistication that standard policies simply don’t provide. Old Harbor Insurance specializes in helping Newport Beach residents build comprehensive protection strategies that match their oceanfront lifestyle and property values. Don’t wait for the next Santa Ana wind or storm surge to discover what your insurance doesn’t cover.

Get a consultation with one of our licensed agents who understands coastal California insurance inside and out. Call us at (951) 297-9740, email info@oldharbor.com, or get a quick quote online—and take the first step toward real peace of mind about your coastal property.

FAQs

Does homeowners insurance cover corrosion from salt air?

No. Salt-air corrosion is considered wear-and-tear and is excluded from standard homeowners insurance. However, damage from a sudden event—such as wind damaging a corroded roof—may be covered, making local coastal expertise important when structuring coverage.

What flood zones require mandatory NFIP flood insurance in Newport Beach?

Properties in Special Flood Hazard Areas (SFHAs)—zones AE and VE—must carry flood insurance if they have a federally regulated mortgage. Zone AE covers 100-year flood areas, while zone VE designates coastal high-hazard areas with wave action and higher insurance costs. Homeowners can confirm their exact zone through the City of Newport Beach’s access to FEMA Flood Insurance Rate Maps (FIRMs).

Are umbrella policies worth it for waterfront homes?

Absolutely—umbrella insurance is essential for Newport Beach waterfront properties. Higher visitor traffic, pools, and decks increase liability exposure, and in California’s litigious environment, a single injury claim can exceed standard $300,000–$500,000 limits and put home equity at risk.

Can I insure a canal-front home differently from beach-adjacent?

Yes. Beach-adjacent homes face direct ocean surge and wave action, while canal-front properties typically face inland flood risk from overflow and storm surge. Because these risks differ by elevation and location, coverage should be structured differently.

What if my property isn’t in an official FEMA flood zone but still floods?

Many Newport Beach homes experience flood damage despite being in zone X or outside mapped flood zones. FEMA maps focus on 100-year flood elevations and don’t fully capture drainage issues, storm surge paths, groundwater rise, or extreme rainfall. With average flood claims exceeding $30,000, flood insurance can be a smart safeguard even when it isn’t officially required.

How does FEMA’s coastal construction guidance affect my insurance?

FEMA’s coastal construction standards reduce wind and flood damage risk, which insurers consider when underwriting coastal homes. Older Newport Beach properties built before these guidelines may face higher premiums or coverage limits, while homes with upgrades like reinforced roofs, elevated utilities, or impact-resistant windows may qualify for better pricing and broader coverage.

How should sea-level rise projections affect my insurance planning?

Southern California sea-level rise projections of 1–4 feet by 2100 mean flood risk is increasing within the next 20–30 years. Homes currently in moderate-risk zones may shift into high-risk zones, raising future flood insurance requirements and costs. Some insurers already factor climate-driven flood risk into underwriting, so long-term flood exposure should be considered when insuring, refinancing, or purchasing coastal property.