The insurance denial letter arrives with clinical efficiency—your application declined, your options narrowing to a single state-mandated alternative. For California homeowners pushed into the FAIR Plan by wildfire risk, understanding exactly what this coverage includes—and more critically, what it excludes—becomes the difference between adequate protection and catastrophic financial exposure.

The California FAIR Plan (Fair Access to Insurance Requirements) functions as the state’s insurer of last resort, providing basic property coverage when private carriers decline to write policies. But “basic” carries weight here: the FAIR Plan offers stripped-down, named-peril protection that leaves significant gaps in the comprehensive coverage most homeowners expect. Knowing these limitations before committing to a FAIR Plan policy prevents costly surprises when you need to file a claim.

If you’re evaluating FAIR Plan coverage or exploring alternatives that might provide more comprehensive protection, Old Harbor Insurance works with California homeowners to structure coverage solutions—whether that’s supplementing FAIR Plan policies with appropriate gap coverage or finding admitted or surplus lines carriers who can provide standalone alternatives.

Understanding the California FAIR Plan Basics

Established in 1968 following widespread insurance market disruptions, the California FAIR Plan operates as a pooled insurance mechanism where all licensed property insurers in the state share the risk of high-hazard properties. When private carriers systematically decline coverage in wildfire-prone areas, the FAIR Plan steps in to ensure property owners can secure at least minimal fire protection.

The program covers fewer than 3% of California residents under normal market conditions, though that percentage has climbed significantly as carriers like State Farm and Allstate curtailed their California homeowners business. The FAIR Plan’s growth from roughly 160,000 policies in 2019 to over 400,000 policies by 2024 reflects the broader insurance market contraction rather than any fundamental change in the program itself.

Understanding the FAIR Plan’s structure matters because it shapes coverage design. This isn’t traditional homeowners insurance repackaged—it’s deliberately limited fire-focused protection designed to provide just enough coverage to satisfy lender requirements when combined with supplemental policies. The program’s mandate centers on ensuring access to basic property insurance, not providing comprehensive risk protection.

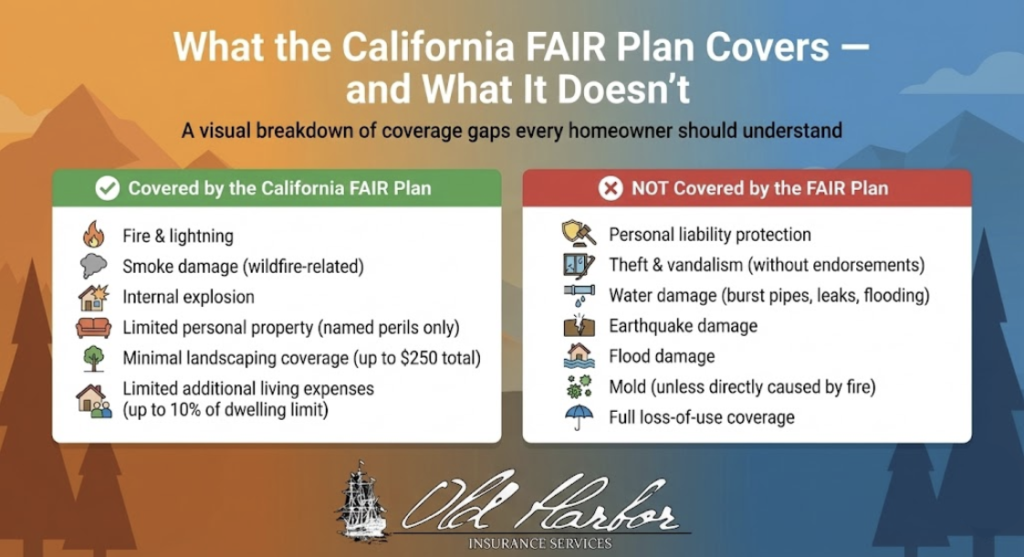

What the California FAIR Plan Covers

Primary Coverage Areas

The base FAIR Plan policy provides named-peril coverage, meaning protection extends only to explicitly listed risks. This contrasts sharply with standard homeowners policies that typically offer “all-risk” coverage protecting against everything except specifically excluded perils.

Standard FAIR Plan coverage includes fire and lightning damage—the core protection driving most policyholders into the program. Smoke damage from wildfires falls under this coverage, addressing the primary risk concern for properties in high-hazard wildfire zones. Internal explosions receive protection, though this peril affects relatively few properties in practice.

Personal property coverage exists within FAIR Plan policies, though the limits and scope differ significantly from comprehensive homeowners insurance. The policy covers belongings inside the insured dwelling up to the selected coverage amount, but only against the named perils listed in the policy—primarily fire and smoke.

Landscaping receives minimal attention: up to $250 coverage for plants, shrubs, and trees damaged by covered perils. This nominal amount barely registers against typical landscaping replacement costs, effectively functioning as token coverage rather than meaningful financial protection.

Residential Coverage Limits

Following regulatory pressure and market disruption, the FAIR Plan doubled residential coverage limits to $3 million per property in 2019. This expansion addressed concerns that previous limits left higher-value homes partially uninsured, though $3 million still falls short for premium properties in expensive coastal markets where replacement costs routinely exceed this threshold.

Personal property coverage integrates into overall policy limits rather than standing as a separate coverage bucket. This structure forces homeowners to allocate their total coverage limit between dwelling protection and contents coverage, potentially creating difficult trade-offs between adequate building coverage and sufficient personal property protection.

Other structures—detached garages, storage sheds, pool houses, guesthouses—receive only 10% of dwelling limits. A property with $2 million dwelling coverage carries just $200,000 for all other structures combined, often inadequate for properties with substantial outbuildings or accessory dwellings.

Commercial Coverage Limits

Commercial FAIR Plan policies underwent significant expansion, addressing business owners’ inability to secure adequate property coverage through traditional markets. Building coverage now extends to $20 million per structure, while total location limits reach $100 million for complex properties with multiple buildings.

Eligible commercial properties span diverse categories: habitational units like apartment buildings, retail and mercantile operations, manufacturing facilities, agricultural properties including farms and wineries, and office buildings. This breadth reflects the program’s mandate to provide coverage access across California’s varied commercial real estate landscape.

Critical Exclusions and What’s NOT Covered

The FAIR Plan’s exclusions often surprise policyholders accustomed to comprehensive homeowners insurance. Understanding what’s not covered proves as important as knowing what protection exists.

Standard Exclusions

Water damage of any kind falls outside FAIR Plan coverage. Flooding from storms, burst pipes, water heater failures, roof leaks—none receive protection under standard policies. For California properties facing both wildfire and flood risk, this creates dangerous gaps requiring separate coverage.

Theft and vandalism receive no protection without purchasing additional endorsements. The base policy provides zero coverage if your home suffers break-ins or intentional property damage, an exclusion that shocks many policyholders expecting standard homeowners insurance protections.

Personal liability protection—coverage when someone injures themselves on your property or you’re sued for damages—doesn’t exist in FAIR Plan policies. Most homeowners insurance claims involve liability more than property damage, making this exclusion particularly significant. If a delivery driver slips on your front steps or your dog bites a neighbor, the FAIR Plan provides no defense or indemnity.

Earthquake and flood damage require separate policies through specialized programs. The California Earthquake Authority handles seismic coverage, while the National Flood Insurance Program provides flood protection. Properties facing multiple perils need multiple policies, creating administrative complexity and often higher total premiums.

Wind and hail damage, falling objects, and freezing damage all remain excluded unless you purchase extended coverage endorsements. The named-peril structure means if a peril isn’t explicitly listed, it’s not covered—the opposite of comprehensive homeowners policies.

Additional Living Expenses

When fire renders your home uninhabitable, the FAIR Plan provides temporary housing assistance, but with severe restrictions. Coverage maxes out at 10% of dwelling limits, significantly less than the 20-30% typical in standard homeowners policies.

For a home with $1 million dwelling coverage, this means just $100,000 for alternative living expenses—potentially inadequate for extended displacement in California’s expensive rental markets. Families displaced for six months or longer often exhaust these limits, leaving them paying out-of-pocket for temporary housing while still covering their mortgage.

Optional Endorsements and Add-On Coverage

While base FAIR Plan coverage remains deliberately limited, homeowners can purchase endorsements expanding protection toward something approaching traditional homeowners insurance.

Available Endorsements

The Extended Coverage Endorsement (ECE) adds windstorm, hail, aircraft damage, civil commotion, and volcanic eruption coverage—perils absent from base policies. Most lenders require this endorsement, making it effectively mandatory rather than optional for mortgaged properties.

Vandalism and Malicious Mischief Endorsement (VMM) provides the theft and intentional damage protection lacking in base policies. Again, lender requirements often drive purchase of this endorsement rather than policyholder choice.

Inflation Guard Protection automatically increases coverage limits annually based on construction cost inflation, preventing gradual erosion of your coverage adequacy as building costs rise. Without this endorsement, you’d need to manually request limit increases each year to maintain replacement cost protection.

Debris removal pays for clearing destroyed materials after covered losses—essential for properties facing total loss where cleanup costs can reach tens of thousands before rebuilding begins. Ordinance and Law Coverage addresses mandatory updates to building codes when reconstructing damaged structures, covering the cost premium of bringing older homes up to current standards.

Dwelling Replacement Cost Coverage insures your home at current reconstruction cost rather than depreciated actual cash value. Without this endorsement, you receive only what your home is “worth” accounting for age and wear—invariably less than what rebuilding actually costs.

Earthquake and Flood Insurance

The FAIR Plan’s exclusion of earthquake and flood coverage necessitates separate policies for comprehensive protection. The California Earthquake Authority provides seismic coverage, while the National Flood Insurance Program handles flood protection.

For properties facing multiple perils—wildfire, earthquake, and flood—you’re managing three separate insurance policies with different deductibles, coverage structures, and claims processes. This fragmentation complicates coverage coordination and often reveals gaps where perils interact (for example, fire following an earthquake).

Difference-in-Conditions (DIC) Policies: Filling the Gaps

Most FAIR Plan policyholders discover they need supplemental coverage to achieve anything resembling comprehensive protection. Difference-in-Conditions policies—commonly called DIC or “wrap-around” policies—fill the substantial gaps in FAIR Plan coverage.

What DIC Policies Cover

DIC policies address the FAIR Plan’s most glaring omissions. Liability protection covers bodily injury and property damage claims against you, legal defense costs, and settlements or judgments—protections completely absent from FAIR Plan policies.

Theft coverage protects personal property from burglary and theft, another exclusion in base FAIR Plan policies. Water damage coverage addresses burst pipes, appliance failures, and similar losses the FAIR Plan won’t touch.

Enhanced loss of use coverage provides more generous temporary housing benefits than the FAIR Plan’s meager 10% of dwelling limits, often extending to 20% or more of coverage amounts.

Industry estimates suggest roughly half of FAIR Plan policyholders purchase DIC coverage, though mortgage lender requirements often drive this decision. Many lenders won’t accept FAIR Plan policies alone, requiring the combination of FAIR Plan fire coverage plus DIC comprehensive protection to satisfy their insurance requirements.

The combined cost of FAIR Plan plus DIC coverage often exceeds what homeowners previously paid for standard homeowners insurance, though it typically remains less expensive than surplus lines alternatives for high-risk properties.

Deductibles and Payment Options

Deductible Choices

FAIR Plan policies offer deductibles ranging from $100 to $10,000, allowing homeowners to balance premium costs against out-of-pocket exposure. Higher deductibles reduce premiums substantially—potentially saving thousands annually—but require adequate emergency funds to cover the deductible if you need to file a claim.

Many homeowners select $2,500 to $5,000 deductibles as a middle ground between premium savings and manageable out-of-pocket costs. Properties with higher coverage limits often carry proportionally higher deductibles since the premium savings increase with policy limits.

Payment Flexibility

The FAIR Plan has modernized payment options, addressing previous criticism about limited payment methods. Monthly payments now come without additional fees, eliminating the surcharge that once penalized policyholders unable to pay annually.

Electronic ACH payments from checking or savings accounts provide automated payment convenience. Credit card payments remain available though processing fees apply. Traditional payment methods—cash, check, or money order—still work for those preferring these approaches.

Wildfire Mitigation Discounts

California’s Safer from Wildfires program incentivizes property hardening improvements that reduce wildfire vulnerability and potentially decrease claim frequency.

Safer from Wildfires Program

Residential and commercial policyholders implementing specific property hardening measures can earn discounts up to 20% on the wildfire portion of their premiums. Qualifying improvements include:

Clearing vegetation and maintaining defensible space according to California’s 100-foot clearance requirements. Installing ember-resistant vents that prevent wind-blown embers from entering attic spaces and starting structure fires. Upgrading to Class-A fire-rated roofing materials—the most fire-resistant classification available.

Trimming tree branches away from structures to prevent fire spread from crown to structure. Removing dead trees and accumulated vegetation that serve as fuel during wildfires.

The discount applies only to the wildfire risk component of your premium, not the entire policy cost, limiting actual savings. However, the improvements themselves often prove more valuable than premium savings by materially reducing your property’s wildfire vulnerability.

Who Is Eligible for the FAIR Plan?

Eligibility Requirements

California property ownership—residential or commercial—represents the primary requirement. The FAIR Plan doesn’t require proof of denial from private insurers, though shopping the traditional market first remains advisable since standard insurance typically provides superior coverage at competitive prices when available.

Properties must meet basic FAIR Plan building and underwriting standards. Structures in severe disrepair or properties with violations may face declination even from the FAIR Plan. Application must occur through a licensed broker or agent rather than directly with the FAIR Plan.

Working with independent insurance brokers provides access to both FAIR Plan coverage and alternative markets simultaneously, ensuring you secure the best available option for your specific property.

Premium Costs and Rate Factors

Cost Considerations

FAIR Plan premiums vary dramatically based on property characteristics and coverage selections. Wildfire risk dominates pricing, with properties in extreme hazard zones paying multiples of what moderate-risk properties cost.

Rebuild cost—the estimated expense to reconstruct your property—drives coverage limits and corresponding premiums. Property characteristics including age, construction type, roof condition, and proximity to other structures all factor into rating.

Coverage selections significantly impact premiums. Base coverage costs substantially less than policies loaded with extended coverage, vandalism endorsements, and replacement cost upgrades. Deductible selection creates premium swings of 20-40% between minimum and maximum deductible options.

As of recent data, FAIR Plan premiums for single-family homes range from approximately $1,800 to $6,000+ annually depending on these variables, though high-risk properties with extensive endorsements can exceed these ranges.

Recent Expansions to FAIR Plan Coverage

2024-2025 Regulatory Updates

California Insurance Commissioner Ricardo Lara has presided over significant FAIR Plan expansions addressing market access concerns. Increased residential limits to $3 million in 2019 doubled previous maximums, though this still leaves high-value homes partially uninsured in premium markets.

Commercial expansion introduced $20 million per-building limits for commercial properties, addressing business owners’ inability to secure adequate property coverage. Flexible payment options eliminated monthly payment surcharges, improving affordability for cash-constrained policyholders.

Agricultural coverage became explicitly available for farm buildings under recent legislative changes. Expanded access for HOAs, affordable housing developers, and farmers addressed previous gaps in program accessibility.

Meeting Mortgage Lender Requirements

FAIR Plan Compliance with Lender Standards

A FAIR Plan policy alone typically fails to satisfy full mortgage lender requirements because it lacks liability coverage, comprehensive personal property protection, water damage coverage, and adequate loss-of-use protection.

Most lenders require homeowners to combine FAIR Plan policies with DIC coverage to meet their insurance requirements. This combination provides fire protection from the FAIR Plan plus liability and additional peril coverage from the DIC policy, satisfying lender mandates for comprehensive protection.

Some lenders prove more flexible than others regarding coverage structure. Discussing your specific situation with your mortgage servicer before finalizing coverage prevents last-minute complications or forced placement of expensive lender-mandated insurance.

How to Apply for California FAIR Plan Coverage

Application Process

Gather comprehensive property information before beginning: square footage, year built, roof type and age, construction materials, recent property photographs, and details about any fire hardening improvements you’ve completed.

Contact a licensed broker authorized to write FAIR Plan policies. The FAIR Plan doesn’t accept direct applications—you must work through an insurance professional. A FAIR Plan representative may inspect your property to assess insurability, particularly for higher-value homes or commercial properties.

Your broker provides coverage options and premium costs across different endorsement combinations and deductible selections. Once approved, pay your first premium to activate coverage.

Application timelines vary based on current demand and property complexity. Recent surge in FAIR Plan applications has extended some processing times, making early application essential if you’re approaching a coverage deadline.

Frequently Asked Questions

Is the FAIR Plan taxpayer-funded?

No. The FAIR Plan operates as a private insurance pool funded by premiums from policyholders and supported by California’s licensed insurance companies through assessments. It functions as a shared-risk mechanism among private insurers rather than a government-run or taxpayer-subsidized program. If the FAIR Plan exhausts reserves following catastrophic losses, all licensed insurers in California contribute additional funds to cover claims.

Can I cancel my FAIR Plan policy and switch to private insurance anytime?

Yes. If you obtain coverage through a traditional insurer—either through improved market conditions or changes to your property that make it more insurable—you can cancel your FAIR Plan policy at any time. Annual policy renewal provides a natural opportunity to shop the private market. Many homeowners periodically check whether admitted carriers will now accept their properties, particularly after completing fire hardening improvements that reduce their risk profile.

Does the FAIR Plan cover mold damage?

Only if mold results directly from a covered peril like fire or smoke. Mold from water intrusion, flooding, or humidity receives no coverage under standard FAIR Plan policies. This exclusion can prove problematic for properties that suffer fire damage followed by water exposure during firefighting efforts, where mold growth becomes a secondary issue. DIC coverage sometimes addresses mold under specific circumstances, though coverage varies by policy.

What happens if the FAIR Plan runs out of money after a major wildfire?

All licensed insurance companies in California are legally required to financially support the FAIR Plan through assessments. If reserves deplete following catastrophic losses, private insurers contribute funds proportional to their California market share. This assessment mechanism ensures the FAIR Plan can pay claims even after events that exceed its reserves, though significant assessments could theoretically impact the broader insurance market.

How long does it take to get approved for a FAIR Plan policy?

Application timelines vary based on current application volume and property complexity. Simple residential applications with straightforward risk profiles often complete within 2-3 weeks. Complex commercial properties or homes requiring physical inspections may take longer. Recent market disruption has increased application volume, extending some timelines. Working with an experienced broker typically speeds the process through proper initial documentation and application preparation.

Can renters get FAIR Plan coverage?

Yes. Renters can obtain FAIR Plan coverage for personal property and liability protection through specialized renters policies. These policies protect tenants’ belongings against covered perils and provide liability coverage if someone is injured in the rented property. Renters insurance through the FAIR Plan functions similarly to standard renters insurance but with the same named-peril limitations and exclusions that characterize FAIR Plan homeowners policies.

Is FAIR Plan coverage available if my property has a history of claims?

Unlike private insurers who heavily weight claims history in underwriting decisions, the FAIR Plan doesn’t deny coverage based on previous claims. Coverage decisions focus on property risk factors—location, construction, condition—rather than the homeowner’s claim history. This distinction makes the FAIR Plan valuable for property owners whose claims experience has made them uninsurable in the standard market, even if their properties don’t face extraordinary wildfire risk.

For California homeowners navigating these complex coverage decisions, consulting with independent insurance professionals who can structure comprehensive protection across multiple carriers and programs provides the expertise this challenging market demands.

Old Harbor Insurance Services helps California homeowners understand their coverage options and structure appropriate protection whether through FAIR Plan combinations, surplus lines alternatives, or standard market coverage. Located in Temecula and serving clients throughout Southern California, their independent broker platform provides access to multiple carriers and coverage solutions. Contact Old Harbor at (951) 297-9740 or visit oldharbor.com to discuss your specific insurance needs.