Receiving a cancellation or non-renewal notice from your homeowners insurance provider ranks among the most stressful experiences for any property owner. Unlike missing a payment deadline you can remedy, a policy termination often stems from factors beyond immediate control—rising claims frequency, evolving underwriting standards, or entire insurers exiting regional markets. The notification arrives with clinical precision: 45 to 60 days until coverage ceases, leaving homeowners scrambling to secure replacement protection before their mortgage lender takes punitive action.

This comprehensive guide examines the mechanics of policy cancellations, immediate response strategies, and practical pathways to securing coverage when standard market insurers decline your applications. Whether your termination resulted from claims history, property condition deficiencies, or market forces reshaping California’s insurance landscape, understanding your options transforms crisis into manageable challenge.

Navigating post-cancellation insurance challenges? Old Harbor Insurance Services specializes in helping dropped homeowners in California secure comprehensive coverage through our network of specialty carriers and high-risk insurers. With over 10,000 clients served across nine states and an A+ BBB rating, our independent agents have the expertise and carrier relationships to find solutions when traditional insurers decline.

Understanding Why Insurance Companies Drop Homeowners

Common Reasons for Policy Cancellation or Non-Renewal

Insurance carriers evaluate risk with increasing sophistication, leveraging satellite imagery, predictive analytics, and granular claims data to identify accounts no longer meeting their underwriting criteria. The most frequent cancellation triggers include:

Claims History: Multiple claims within a three-to-five-year window signal elevated risk to underwriters. Filing two or more claims—even for different perils—often results in non-renewal regardless of payout amounts. Insurers view claim frequency as predictive of future loss potential.

Property Condition Issues: Modern carriers employ aerial surveillance and third-party inspection services to identify maintenance deficiencies. Missing roof shingles, outdated electrical systems, deteriorated siding, or inadequate vegetation clearance in wildfire zones trigger immediate underwriting reviews. Discovering undisclosed conditions through these inspections provides grounds for cancellation.

Credit-Based Insurance Scores: In states permitting this practice, significant drops in credit-based insurance scores signal increased risk to carriers. While controversial, these scoring models correlate payment reliability with claim propensity, making credit deterioration a cancellation factor.

Payment Delinquencies: Non-payment remains the most straightforward cancellation cause. Missing premium payments by 30+ days typically triggers immediate policy termination with minimal recourse.

Market Capacity Shifts: Carriers periodically exit entire markets or product lines when loss ratios become unsustainable. Homeowners in these scenarios face cancellation through no fault of their own—simply residing in regions where catastrophic loss potential exceeds the insurer’s risk appetite.

Material Misrepresentation: Providing inaccurate information on applications—whether intentional or inadvertent—constitutes grounds for immediate policy rescission. This includes undisclosed renovations, home business operations, or structural modifications.

Natural Disasters and Geographic Risk Factors

California homeowners face unprecedented market disruption as major carriers reassess wildfire exposure. State Farm, Allstate, and other national carriers have implemented non-renewal programs affecting tens of thousands of policies annually. These market exits transcend individual homeowner risk profiles—entire ZIP codes lose access to standard market coverage as insurers recalibrate catastrophe exposure.

Hurricane-prone coastal regions face similar dynamics. Florida and Louisiana homeowners confront shrinking carrier options as climate-driven loss trends reshape underwriting models industry-wide.

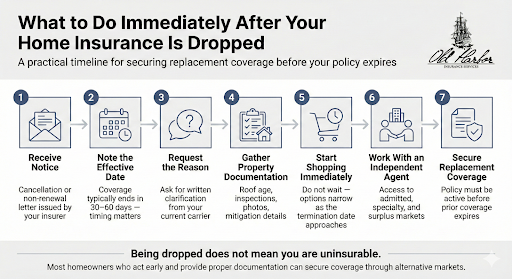

Immediate Steps to Take After Receiving a Cancellation Notice

Act Quickly and Review Your Notice

State regulations typically mandate 45 to 60 days advance notice for non-renewals, with some jurisdictions requiring longer notification periods. This window represents your primary opportunity for organized response:

Contact your current insurer immediately to obtain detailed cancellation reasoning. Generic notice language often obscures specific underwriting concerns addressable through property improvements or documentation clarification.

Request written clarification if initial explanations remain vague. State insurance departments require carriers to provide substantive cancellation justification upon policyholder request.

Gather comprehensive documentation including prior inspection reports, maintenance records, and claims correspondence. This information proves essential when applying with new carriers.

Evaluate remedy possibilities. Some cancellation triggers—roof repairs, hazard removal, vegetation management—allow homeowners to address deficiencies and potentially qualify for standard market coverage.

Understand Cancellation vs. Non-Renewal

These terms carry distinct meanings with different implications:

Cancellation occurs mid-policy term. During the initial 60 days of coverage, insurers maintain broad cancellation authority. After this period, carriers can only cancel for specific reasons: non-payment, material misrepresentation, or substantial risk increase.

Non-renewal happens at policy expiration. Insurers possess broader discretion here, declining to extend coverage for evolving underwriting standards, changing business strategies, or risk reassessment. No obligation exists to continue coverage beyond the policy term.

Understanding this distinction helps frame expectations and response strategies.

Finding Coverage Through the Standard Market

Shop Multiple Insurers Immediately

Begin replacement coverage search immediately upon receiving cancellation notice. Waiting until days before termination eliminates options and increases desperation:

Contact regional and specialty carriers directly. While major national insurers may decline, regional companies like Foremost, Stillwater, and Grange Insurance specialize in higher-risk placements.

Engage independent insurance agents with access to multiple carrier appointments. Unlike captive agents representing single companies, independent brokers maintain relationships with specialty insurers specifically designed for post-cancellation placements.

Utilize online comparison platforms to evaluate multiple quotes simultaneously, though recognize these tools may exclude specialty carriers requiring traditional underwriting processes.

Document your home improvements proactively. Recent roof replacement, updated electrical systems, or defensible space improvements in wildfire zones strengthen applications with new carriers.

Why Independent Agents Matter

Independent insurance agents offer distinct advantages for dropped homeowners. Unlike captive agents bound to single company guidelines, independent brokers like Old Harbor Insurance Services access dozens of carriers—including specialty insurers designed specifically for challenging placements.

This multi-carrier access proves critical. When Carrier A declines due to claims history, an independent agent simultaneously submits to Carriers B, C, and D with different underwriting appetites. The process compresses weeks into days, preventing coverage gaps that trigger expensive force-placed insurance from mortgage lenders.

Independent agents also understand carrier-specific nuances. Some specialty insurers overlook older claims if recent history remains clean. Others focus primarily on property condition regardless of claims. This specialized knowledge—developed through hundreds of challenging placements—dramatically improves approval odds.

Prepare Strong Applications

Application quality directly influences approval probability. Strengthen your positioning through:

Complete transparency about claims history. Attempting to obscure prior claims invariably surfaces during underwriting, resulting in automatic declination and complicating future applications.

Organized property maintenance documentation. Receipts for roof work, electrical upgrades, or structural improvements demonstrate proactive risk management. Before-and-after photographs prove particularly persuasive.

Address known deficiencies before applying. If your cancellation stemmed from roof condition, complete repairs before submitting new applications. Half-measures rarely satisfy underwriters.

Demonstrate risk mitigation efforts. Installing monitored security systems, upgrading to impact-resistant roofing, or creating defensible space in wildfire zones shows insurers you’re actively reducing loss probability.

Exploring Government-Backed Options

State FAIR Plans: Your Safety Net

When standard market insurers decline coverage, state FAIR (Fair Access to Insurance Requirements) plans provide last-resort options. These state-mandated programs exist in most high-risk markets, though specific structures and coverage limits vary significantly.

FAIR plans offer basic dwelling coverage and liability protection for properties considered too risky for private insurers. While these programs fulfill essential insurance requirements, homeowners should understand their limitations:

Coverage caps typically fall below replacement cost for many properties, requiring supplemental policies for full protection.

Premiums exceed standard market rates significantly—sometimes by 200-300% for comparable coverage.

Limited additional coverage options mean fewer endorsements for personal property, loss of use, or specialized protections.

Underwriting remains strict despite last-resort positioning. Properties requiring substantial repairs may face declination even from FAIR plans until improvements are completed.

For California homeowners, the California FAIR Plan provides this essential coverage safety net. While premiums run high, FAIR plan coverage prevents force-placed insurance from mortgage lenders—an even more expensive alternative.

How to Access Your State’s FAIR Plan

Contact your state insurance commissioner’s office or visit their website for FAIR plan information and application procedures. Processing timelines typically span 2-4 weeks, making immediate application advisable even while pursuing standard market options.

Independent agents familiar with FAIR plan processes can expedite applications and identify supplemental coverage options to fill gaps in basic FAIR plan protection. Old Harbor Insurance Services maintains extensive experience with California FAIR Plan placements, helping clients navigate applications while continuing to seek better standard market alternatives.

Addressing the Root Causes of Your Cancellation

Making Necessary Home Repairs

Property condition cancellations require tangible improvements before most carriers reconsider coverage:

Roof replacement or comprehensive repairs address the most common underwriting concern. Modern synthetic roofing materials often qualify for premium discounts while satisfying underwriting requirements.

Electrical system upgrades from knob-and-tube or aluminum wiring to modern copper wiring eliminate major underwriting obstacles.

Plumbing updates replacing galvanized or polybutylene pipes demonstrate proactive maintenance reducing water damage risk.

Structural remediation addressing foundation issues, dry rot, or pest damage proves essential for carrier approval.

Defensible space creation in wildfire-prone areas—removing dead vegetation, maintaining minimum clearances, using fire-resistant landscaping—increasingly determines insurability in California’s high-risk zones.

Document all improvements with contractor invoices, building permits, and professional inspection reports. This documentation provides underwriters concrete evidence of risk reduction.

Rebuilding Your Claims Record

Claims history requires time to overcome, but strategic approaches accelerate the process:

Avoid filing small claims during your next policy period. Self-funding minor losses below deductible thresholds prevents additional claim frequency accumulation.

Increase deductibles substantially if financially feasible. Higher deductibles—$2,500 to $5,000 or more—discourage minor claim filing while demonstrating financial stability to underwriters.

Maintain meticulous preventive maintenance to reduce future claim probability. Regular HVAC servicing, plumbing inspections, and roof maintenance prevent small issues from escalating into major losses.

Document ongoing home improvements that reduce risk. Installing water leak detection systems, upgrading to impact-resistant windows, or adding sump pumps creates a narrative of proactive risk management.

Most carriers evaluate 3-5 year claim windows. Each year without new claims improves your insurability profile, eventually opening access to better coverage terms.

Protecting Yourself Moving Forward

Best Practices to Avoid Future Cancellation

Once you’ve secured replacement coverage, protecting that policy becomes paramount:

Pay premiums automatically through bank draft to eliminate payment delinquency risk entirely.

Maintain open communication with your insurer about property changes, renovations, or alterations requiring endorsements.

Review coverage annually rather than treating insurance as set-and-forget protection. Regular reviews identify coverage gaps while ensuring adequate limits as property values appreciate.

Reserve claims for catastrophic losses only. Minor losses below $2,000-$3,000 rarely justify the long-term insurability impact of additional claims.

Invest in preventive maintenance aggressively. The few hundred dollars spent on annual roof inspections or plumbing maintenance prevents the thousands in claim costs—and subsequent policy jeopardy.

Photograph and document your property condition annually. This creates evidence of proper maintenance should underwriting questions arise.

The Importance of Regular Policy Reviews

California’s volatile insurance market makes annual policy reviews essential rather than optional. Carrier appetite shifts, new specialty insurers enter markets, and your own risk profile evolves over time.

Working with an independent agent like Old Harbor Insurance Services ensures continuous market monitoring. As your claims history ages or property improvements are completed, agents can pursue better coverage terms with different carriers. What proved impossible 18 months ago may become achievable as both your profile and market conditions change.

Regular reviews also identify coverage gaps before they create problems. Renovation projects, home business operations, or valuable personal property acquisitions often require endorsements standard policies don’t automatically include.

FAQs About Homeowners Insurance After Cancellation

How does being dropped affect my ability to shop for better rates in the future?

A cancellation or non-renewal creates a 3-5 year underwriting lookback period where most standard market insurers will either decline your application or place you in high-risk tiers with substantially elevated premiums. However, this timeline isn’t static – each claim-free year progressively improves your insurability profile.

After 18-24 months without new claims, certain specialty carriers begin offering more competitive rates. After three years, some standard market insurers reconsider applications, particularly if you’ve completed property improvements and maintained continuous coverage. The key strategy involves starting with available specialty coverage immediately, then systematically shopping your policy annually as your claims history ages.

Independent agents maintain relationships with carriers at every risk tier, allowing strategic transitions from high-risk specialty insurers to mid-tier carriers to eventual standard market placement. Waiting to “let things blow over” before securing any coverage actually worsens your position – continuous coverage gaps themselves become underwriting red flags. Contact Old Harbor Insurance Services to develop a multi-year strategy that positions you for progressively better rates as your record improves.

What happens if I can’t afford the premiums specialty insurers or FAIR Plan quote me?

Premium affordability challenges after cancellation require strategic rather than reactive responses. First, maximize your deductible – increasing from $1,000 to $5,000 can reduce premiums 15-25% while forcing discipline around claim filing that improves long-term insurability. Second, reduce coverage to minimum lender requirements temporarily while addressing the root cancellation causes.

If your mortgage requires $400,000 dwelling coverage but your property needs $550,000 for full replacement cost, temporarily insuring to the lower threshold maintains compliance while reducing premium burden. Third, explore payment plans that spread annual premiums across monthly installments rather than lump-sum payments.

Fourth, aggressively pursue property improvements that generate premium credits – roof upgrades to impact-resistant materials, monitored security system installations, or wildfire mitigation measures often qualify for 5-15% discounts that partially offset elevated base rates. What doesn’t work: allowing coverage to lapse entirely. Force-placed insurance from your lender costs 3-5 times more than even the most expensive FAIR Plan coverage while providing minimal protection. If affordability remains impossible despite these strategies, discuss with Old Harbor Insurance Services – our agents often identify carrier-specific programs or state assistance options that reduce premium burdens for qualifying homeowners.

Should I accept my current insurer’s offer to keep coverage if I make specific improvements?

Conditional non-renewal offers – where insurers agree to maintain coverage if you complete specified improvements within defined timeframes – deserve careful evaluation rather than automatic acceptance.

Consider these factors: First, verify the improvement timeline is realistic – carriers often demand roof replacement or major electrical work within 30-60 days, timeframes that may prove impossible given contractor scheduling and permit requirements.

Second, obtain written confirmation that completing improvements guarantees renewal at specified rates. Verbal assurances from customer service representatives lack enforceability – demand formal written amendments to your cancellation notice specifying exact improvement requirements and guaranteed renewal terms.

Third, compare the cost of required improvements plus your renewal premium against obtaining new coverage elsewhere without making improvements.

Fourth, recognize that conditional renewals often come with substantial premium increases even after improvement completion. Your rate might double despite satisfying all requirements. Independent agents can model both scenarios. Old Harbor’s team regularly evaluates these conditional offers for clients, identifying whether acceptance or alternative placement delivers better long-term value.

How do I handle insurance shopping if I’m selling my home soon after cancellation?

Home sales following insurance cancellation create timing complications requiring strategic coordination between your insurance agent, real estate agent, and escrow officer. Most purchase agreements require sellers to maintain active coverage through close of escrow – allowing policy cancellation before ownership transfers can void purchase contracts or delay closings.

Your options include: securing short-term specialty coverage or FAIR Plan placement specifically to satisfy the closing period, then allowing cancellation once title transfers. Many specialty insurers offer 3-6 month policy terms rather than requiring annual commitments, reducing premium outlay for coverage you’ll only need briefly.

What role do home inspection companies play in modern cancellations?

Insurance carriers increasingly contract third-party inspection services that use drone imagery, satellite analysis, and drive-by assessments to evaluate properties without homeowner knowledge. Companies like Verisk and CoreLogic provide carriers with detailed roof condition reports, vegetation encroachment analysis, and property maintenance scoring that trigger cancellation reviews. These inspections often identify issues invisible from ground level—missing shingles, moss accumulation, inadequate defensible space—that wouldn’t surface during traditional adjuster visits. Homeowners frequently receive cancellation notices citing “recent inspection findings” without realizing their property was remotely evaluated months earlier. Proactively commissioning your own professional inspection before renewal periods allows you to address deficiencies before carrier inspections identify them. This defensive strategy proves particularly valuable for properties in wildfire zones or coastal areas where carriers intensify surveillance.

Can I negotiate with my insurance company to reverse a cancellation decision?

Negotiation success depends entirely on cancellation reasoning.

Non-payment cancellations offer zero negotiation opportunity—premium payment immediately or coverage terminates. Property condition cancellations sometimes allow negotiation if you can demonstrate improvements completion within carrier-specified timeframes, though carriers rarely extend these deadlines beyond initial offers. Claims-based cancellations prove most negotiation-resistant—underwriting algorithms flagging claim frequency operate mechanically with minimal adjuster discretion.

Your strongest leverage involves correcting factual errors: if cancellation cites claims you never filed or property conditions that don’t exist, documented evidence sometimes reverses decisions. California law requires carriers to provide specific cancellation justification upon request—vague notices like “underwriting review” insufficient for legal compliance. If your carrier refuses detailed explanation or you believe cancellation violates state regulations, file formal complaints with California’s Department of Insurance. However, pragmatically, most homeowners achieve faster results securing alternative coverage through independent agents than fighting cancellation decisions through administrative channels.

Do I need to disclose my cancellation when applying with new insurers?

Yes, absolutely. Insurance applications specifically ask about prior cancellations, non-renewals, and declined coverage within the past 3-5 years. Omitting or misrepresenting this information constitutes material misrepresentation—grounds for immediate policy rescission if discovered, even years later. This creates catastrophic scenarios where you believe you maintain coverage, file a major claim, and discover your policy is void due to application fraud.