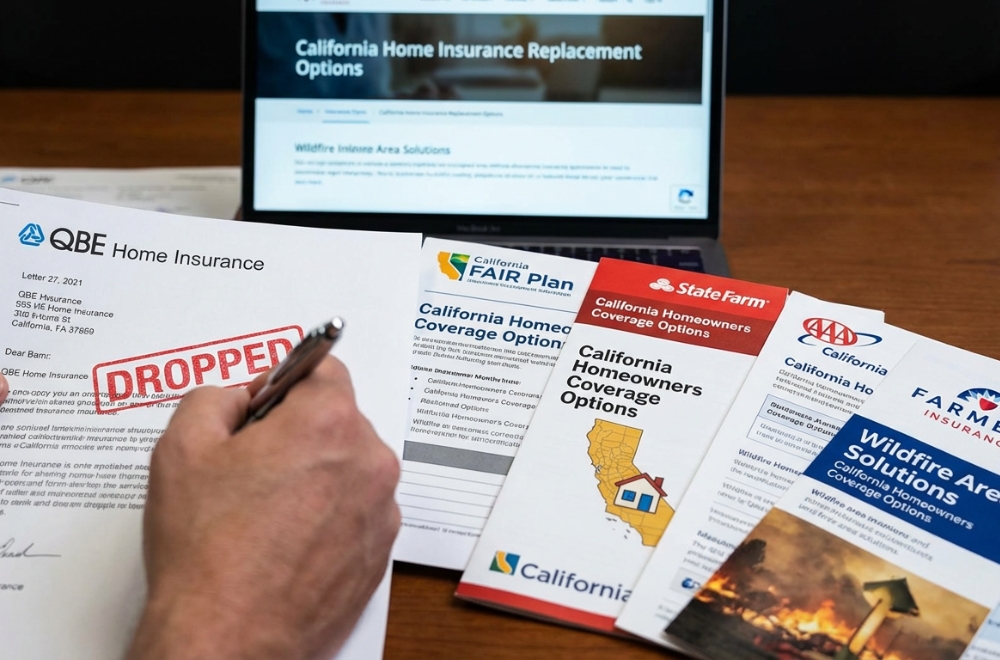

If you’re a QBE Home Insurance customer in California, you may have received notice that the company is exiting the U.S. homeowners market, impacting about 37,000 policyholders. This decision isn’t about your property—it reflects mounting pressure in California’s insurance market. The priority now is securing replacement coverage with help from experienced independent agents like Old Harbor Insurance.

Homeowners insurance represents only a small share of QBE’s global business, prompting the company to refocus on commercial lines. The key now is to act quickly and secure new coverage—often with options better suited to California’s current market. This guide outlines your next steps and explains how Old Harbor Insurance helps homeowners navigate the transition after QBE’s exit.

Why Insurance Companies Are Abandoning California

QBE’s exit isn’t an isolated event. California’s homeowners insurance market is under strain from several converging pressures that have pushed many major carriers to reduce exposure or leave the state entirely.

Wildfire Losses and Rising Rebuild Costs

Wildfires are now the primary driver of insurer losses. The January 2025 Los Angeles wildfires alone caused an estimated $33.9 billion in damage, while rebuilding costs have surged—rising as much as 57% since 2017 due to labor shortages and supply-chain issues.

Regulatory and Reinsurance Pressure

California’s Proposition 103 restricts how quickly insurers can raise rates, limiting their ability to offset growing losses. At the same time, reinsurance costs have tripled in some cases. When carriers can’t adjust pricing to cover wildfire risk and reinsurance expenses, exiting the state becomes the only viable option.

QBE’s Timeline and Your Protection Window

California law requires insurers to provide at least 75 days’ notice before non-renewal, giving you time to secure replacement coverage. QBE’s exit will occur gradually as policies reach their renewal dates, meaning you’re not facing an immediate loss of coverage—but a transition period where early action matters.

Additional protection may apply if the Governor declares a wildfire-related state of emergency, which can temporarily restrict non-renewals in affected areas. The key is to act without panic: starting your search now allows you to compare options carefully and avoid coverage gaps that could trigger costly force-placed insurance from your lender.

Top Alternative Carriers Now Accepting California Homeowners

Despite market contraction, several insurers continue offering homeowners coverage in California. Each carrier serves different needs, making the right fit highly dependent on your property and risk profile.

Best Options by Homeowner Profile

Amica Mutual is consistently rated among California’s top homeowners insurers, known for strong customer service and reliable claims handling. USAA remains a standout for military members and their families, offering competitive pricing and solid replacement cost coverage for eligible households.

Flexible and Cost-Conscious Choices

Travelers Insurance provides competitive premiums and flexible features such as green home coverage and extended payment grace periods after emergencies. Mercury Insurance is often among the most affordable options in the state, appealing to budget-focused homeowners willing to accept higher complaint volume in exchange for lower premiums.

High-Value and Custom Home Specialists

Progressive Insurance offers customizable coverage options suited to a wide range of homeowners, while Chubb Insurance specializes in high-value and custom homes, with replacement cost limits far beyond standard markets—ideal for luxury properties.

Why Agent Access Matters

An independent agent at Old Harbor Insurance can quote these carriers and specialty markets not available online, helping you identify the best option based on coverage needs—not just price.

Reliable Backup Coverage Options

When standard coverage isn’t available, the California FAIR Plan acts as the state’s insurer of last resort. It provides basic fire-related coverage—including fire, lightning, smoke, and internal explosion—with dwelling limits up to $3 million. However, it excludes liability, theft, and most water damage, making it a temporary or gap-filling solution rather than full protection.

Why FAIR Plan Use Has Increased

More than 1 million Californians now rely on FAIR Plan coverage as private insurers continue to withdraw. Premiums are higher because the plan insures the state’s highest-risk properties, but it remains a critical option when no standard carrier will quote.

Excess & Surplus (E&S) Carriers

Excess and Surplus carriers offer another alternative for difficult placements. These non-admitted insurers operate outside standard rate regulations and specialize in higher-risk or unique properties. While typically more expensive, they provide flexibility unavailable in the admitted market and are regulated through State Surplus Line Offices, according to the California Department of Insurance.

Regional Specialty Insurers

Some regional insurers focus specifically on high-risk states like California. These specialty carriers often understand local risk better than national insurers and may accept properties that larger companies decline outright.

How Old Harbor Insurance Helps You Navigate This Transition

As an independent agency based in Temecula, Old Harbor Insurance helps California homeowners navigate non-renewals and market exits. Unlike captive agents tied to one carrier, Old Harbor works with multiple insurers at once—allowing real comparison and better-fitting coverage options.

Personalized Guidance and Ongoing Support

Old Harbor’s agents focus on education and tailored solutions, taking time to understand your property, coverage history, and concerns. They review deductibles, limits, and risk-specific protections to ensure your policy truly fits your needs. Beyond placement, Old Harbor also provides claims support—advocating for you, coordinating with carriers, and helping ensure fair treatment when it matters most.

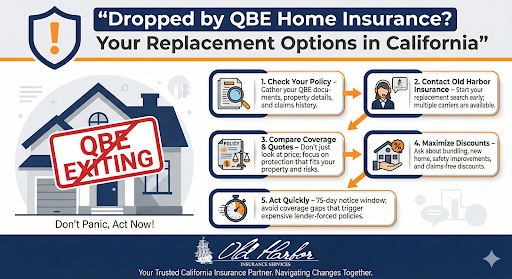

Your Action Plan: Securing Coverage Now

Step 1: Gather Your QBE Policy Documents

Collect your current policy, property details, claim history, and any recent inspections or home improvement documentation. This information accelerates the quote process and gives carriers what they need to provide competitive rates.

Step 2: Contact Old Harbor Insurance Immediately

Call (951) 297-9740 or email info@oldharbor.com to begin exploring alternatives. Don’t wait for your non-renewal notice to arrive. Independent agents like Old Harbor can shop multiple carriers simultaneously, saving weeks of individual quote requests. Timeline matters—your 75-day window closes faster than you expect.

Step 3: Compare Quotes and Coverage Options

Review quotes from multiple carriers, comparing not just price but coverage details. A cheaper policy that excludes critical protections costs more in claims. Your agent helps you understand which coverage options matter most for your property and risk profile.

Step 4: Identify Available Discounts

Ask about bundling discounts (combining home and auto), new home discounts, fire safety improvements, claims-free discounts, and good credit discounts. These can reduce premiums 10-20% or more, depending on the carrier and your circumstances.

Cost-Saving Strategies for California Coverage

Investing in home hardening can expand your insurance options and lower premiums. Measures like defensible space, fire-resistant roofing, ember-resistant vents, and upgraded HVAC systems make your property more attractive to insurers. The California FAIR Plan even offers discounts for completing approved safety improvements.

Lower Premiums Through Smart Policy Choices

Choosing higher deductibles—such as $1,000 or $2,500—can significantly reduce monthly premiums, especially if you have an emergency fund to cover potential out-of-pocket costs. Limiting small claims also helps protect your rates, reserving insurance for major losses rather than minor repairs.

Maximize Discounts Through Bundling

Bundling home and auto insurance with the same carrier can generate discounts of 10–20%. Working with Old Harbor Insurance allows you to explore bundling options across multiple carriers, helping you balance cost savings with the coverage you actually need.

Your Coverage Solution Is Waiting

QBE’s exit from California feels like rejection, but it’s actually a market reset that opens new options. Multiple carriers continue writing California homeowners insurance, and some might offer better coverage at better prices than QBE provided. What matters now is acting decisively during your 75-day window.

Old Harbor Insurance has guided thousands of California homeowners through carrier exits and market disruptions. Their independent agent status means access to carriers most homeowners never discover, personalized consultation that respects your situation, and genuine partnership throughout the process. Call them at (951) 297-9740, email info@oldharbor.com, or visit their Temecula office at 43015 Blackdeer Loop, Suite 201. Your replacement coverage exists—let’s find it together.

FAQs

When will my QBE policy be canceled?

QBE will issue non-renewal notices once regulatory processes complete. You have at least 75 days from notification to secure alternative coverage. California law requires this notice period, giving you meaningful time to shop and transition.

Can I transfer my QBE policy to another company?

No, policies don’t transfer directly. You’ll need to apply for a new policy with a different insurance company. The application process typically takes 1-2 weeks with standard carriers.

Will my premiums increase when switching insurers?

Rates vary significantly by carrier and your property details. Shopping with multiple insurers ensures you find the best available rates. Sometimes switching carriers actually reduces premiums despite market-wide increases.

What if I can’t find traditional coverage?

The California FAIR Plan provides basic coverage as a last resort. You can also explore E&S policies or regional specialty insurers, though these typically cost more than standard coverage.

Should I join the FAIR Plan now or wait?

Secure private market coverage if available, as FAIR Plan policies offer limited coverage and higher premiums. Only use the FAIR Plan if you cannot qualify for standard market policies after genuine effort.

Can I get quotes online?

While some insurers offer online quotes, California’s complex market means working with an independent agent often provides better service and access to carriers not available directly online. Agents have tools and relationships online systems can’t replicate.

What discounts should I ask about?

Ask about bundling, new home discounts, safety device discounts (alarm systems, deadbolts), fire mitigation improvements, claims-free discounts, and good credit discounts. Your agent ensures you capture every available savings.

What if I’m in a high-risk wildfire area?

High-risk properties face more carrier restrictions, but alternatives exist through E&S carriers and specialty insurers. Focus on home hardening and defensible space improvements to improve your insurance profile. Some carriers offer better terms for properties with documented mitigation.

How do I know if a carrier is financially stable?

Check financial ratings through A.M. Best or Standard & Poor’s. Old Harbor only works with carriers maintaining strong financial ratings to protect your claims in catastrophic events.

Can I bundle coverage to lower costs?

Yes. Combining home and auto, or home and other policies, with the same carrier typically yields 10-20% discounts. Old Harbor can explore bundling across multiple carriers to find optimal savings.