OLD HARBOR INSURANCE

Long Term Care (LTC) Coverage in Temecula CA

Premium insurance

Long Term Care (LTC) Coverage

According to the CDC, Americans are now living longer than the generations before them. That fact coupled with rising health care costs across the nation is leaving many of the elderly exposed to the limitations and shortcomings of Medicare and Medicaid – the need for Long-Term Care (LTC) coverage has never been more important.

Many of us will need care as we age.1

Americans age 65 and older

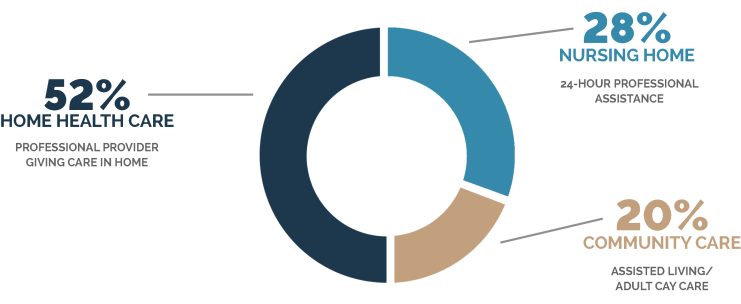

When given the choice, many people remain in their own homes while receiving care.2

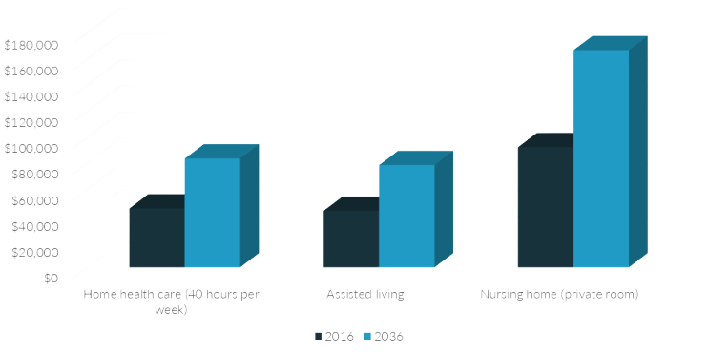

LTC is expensive, and the cost continues to grow.3

People receive LTC for an average of 2.5 years in a nursing home and 4.5 years outside a nursing home. If you need care, where will this money come from?

- 1 “Medicare & You 2015.” Center for Medicare & Medicaid Services (September 2014)

- 2 “The 2015-2016 Sourcebook for Long-Term Care Insurance Information.” American Association for Long-Term Care Insurance (2015).

- 3 “Genworth Cost of Care Survey 2016.” Genworth Financial (May 2016).

Our Lines of Coverage

We are Here to Help

We understand the conversations of aging and no longer being self-sufficient are challenging. We’re here to walk through the process with you. Discussing LTC is something that all individuals should do, yet most do not. There are cost-effective routes to help you avoid the high costs many of us will face as you age. At Old Harbor Insurance we have many Long-Term Care Long-Term Care options available and can tailor coverages to suit your family’s needs.

Below are a few options available among our Long-Term Care providers:

- Lump Sum Payment Plans or Monthly Pay.

- Long-Term Care Benefit Periods up to Seven (7) Years.

- Return of Premium Option • Guaranteed Death Benefit Option (Even if all LTC benefits have been exhausted.)

Our Lines of Coverage

There Are Two Ways That LTC Benefits Can Be Paid

- The most common LTC policies are paid on a reimbursement basis. You submit bills and/or receipts to the carrier and they in turn reimburse you for qualifying expenses up to the specified monthly limit.

- The plan Old Harbor highly recommends, if you qualify, is a cash indemnity policy. There is no monthly submittal process. With cash indemnity coverage, the company sends you a monthly benefit check that can be used for any expenses you deem necessary.

Frequently Asked Questions

How Can We Help?

When do LTC benefits typically start being paid?

Your doctor must certify that:

- You have a severe cognitive impairment, or

- Are unable to perform two or more activities of daily living (ADL): bathing, eating, continence, toileting, dressing yourself, or getting in/out of bed.

What about Medicare and Medicaid? How much help can I expect from those programs?

Source: “Paying for Long-Term Care.” Medicare.gov (Dec 27, 2016)

What about increasing health care costs? Is there a way to insulate myself against inflation?

Many of our carriers allow either a simple or compound inflation to hedge against increasing costs in the future.

What are some examples of what I may need Long-Term Care coverage for?

Home health care, Nursing home care, Hospice services, Family care, Home safety improvements, Household services such as home or yard maintenance.

Let Us Handle Your Loved

One's Long Term Care

Old Harbor is the choice for Long Term Care insurance.