Have you ever been reluctant to obtain personal liability coverage because you weren’t sure what it was all about?

Well, the journey of owning a home involves a lot of paperwork and expenses. After closing the deal, you have to inevitably acquire homeowners insurance to protect your property from unexpected damage or loss.

However, standard home insurance is not enough to protect you from the financial risks. You also need to acquire personal liability coverage to keep your property safe for your neighbors, visitors, and even trespassers.

This is the only way to avoid lawsuits for damage, injuries, or losses you, your family members, or your pets cause to other people inside or outside your home!

Enlisting the services of an independent insurer can help answer all the tough questions you might have about homeowners liability insurance and how the policy work

In this post, we discuss everything you need to know about homeowners liability insurance and what it covers. Here’s a detailed outline of what you should expect.

- Defining homeowners liability insurance

- How a homeowners liability insurance policy works

- What does homeowners liability insurance cover?

- What homeowners liability insurance does not cover

- Reasons to enlist an independent insurer for your homeowners liability insurance

Defining Homeowners Liability Insurance

Buying a home is undoubtedly one of the most rewarding and best decisions you could ever make. The prestige and security that come with owning a home are what everyone yearns for.

Besides, homeowners enjoy a wide range of benefits ranging from tax rebates to enhanced credit access.

However, as much as owning a home is rewarding, you still have to take care of various expenses that are somewhat inevitable.

One of the most important expenses you should consider in your homeownership journey is home insurance.

Homeowners insurance is an exclusive type of insurance that protects your property, personal belongings, furnishings, and other assets in your home, from damage and loss.

Nevertheless, standard homeowners insurance can only do so much in the sense that it only protects your house and your belongings from damage. It DOES NOT provide cover for injuries to other people on your property.

For instance, if someone comes to visit, then slips and breaks their arm in your home due to an unrepaired walkway, they can hold you liable. You might end up paying thousands of dollars in damages and medical fees in case the victim files a lawsuit against you.

So, what happens in the event someone gets hurt on your property?

This is where the importance of homeowners liability insurance (personal liability insurance) comes into play.

As the name implies, personal liability insurance is an integral component of homeowners insurance. Personal insurance protects homeowners like you and your household from claims resulting from injuries to third parties on your property.

By obtaining a liability insurance policy, you, your family, or even your pets will not be held responsible for any damage or injury caused to third parties.

Better yet, you won’t have to pay large sums of money out of your pocket for medical expenses, legal fees, and other claims resulting from damage to other people.

How Homeowners Liability Insurance Works

Liability losses are among the most expensive claims homeowners have to face. A single lawsuit could cost you hundreds of thousands in medical bills, legal costs, and pain and suffering in case you are found liable.

To avoid all the trouble, you are advised to purchase liability insurance along with your standard home insurance. Homeowners liability insurance protects you from the financial implications arising from lawsuits against you and your household.

When someone files a claim against you, the underlying policy comes into effect first until the limit on the standard home insurance policy is reached. In case of any balance, the personal liability coverage will take care of the rest to the set limit.

If the claim is substantial, you may have to dig deep into your pockets to clear the balance. However, an umbrella insurance policy can give you the peace of mind that you deserve, by providing additional liability coverage.

You may purchase liability insurance separately or with your standard home insurance policy, or as part of an umbrella insurance policy. In case you are confused about which policy to purchase, talking to an independent insurer could prove useful.

What Does Homeowners Liability Insurance Cover?

Did you know that homeowners liability insurance provides coverage in case your dog bites a neighbor or harms a trespasser? Well, we thought you should know!

In this section, we discuss in detail what homeowners liability insurance covers.

Medical Bills for Injured Persons

If a guest, neighbor, or even a trespasser is injured on your property, it is only logical that you settle their medical expenses.

The victim can file a lawsuit against you to take care of their medical bills even if they have health insurance. This is particularly true if the accident happened because of your negligence.

Homeowners liability insurance can help settle any medical expenses that arise, so you don’t have to out of your pocket.

Pain and Suffering Costs

Did you know that you could get sued for causing pain and suffering?

If the injured person does not require medical attention, they can still sue for pain and suffering as long as the physician’s report indicates that the victim is enduring some form of pain. Liability insurance can help settle any claims against you or your family.

Cost of Repairs to Your Neighbor’s Property

Liability insurance covers any damage caused to your neighbor’s property by you, a member of your household, or a pet.

A good example where liability coverage comes into play is when a diseased tree falls and damages your neighbor’s property. Liability insurance will settle the cost of repairs.

Negligent Acts of Children

Children can be excessively playful and sometimes naughty. However, if you don’t watch what your kids do during playtime, they might indulge in mischievous games that could cost you a lot of money in damages.

For instance, if your child kicks a ball through your neighbor’s window, you will have to pay for the damage caused out of your pocket if you don’t have liability insurance coverage.

Cost of Legal Defense

If someone files a case against you following an accident on your property then you have no choice but to answer to charges. Now, going through settlement cases can be an expensive journey. First, you need to hire a lawyer and pay for any legal fees if you are found liable.

The good news is that liability insurance can help cover legal costs in case you find yourself in court.

Lost Wages

If someone gets injured on your property and that injury leads to a loss of wages, then they may sue you for compensation.

The compensation amount depends on the extent of the injury. In some instances, your insurer may have to pay long-term benefits in case of permanent disability.

Death Benefits for the Claimant’s Family

It might sound unimaginable, but some accidents on your property might turn fatal, leading to loss of life. Liability insurance may cover death benefits to the family of the deceased.

However, you first need to check with your insurer if this option is available as part of the liability policy.

Liability Coverage Away from Home

Believe it or not, but liability insurance also protects you and your family members from any damages or financial losses that might occur when you are away from home.

For instance, if you are on vacation and you happen to accidentally cause damage to items in your hotel room, liability coverage will reimburse the hotel accordingly.

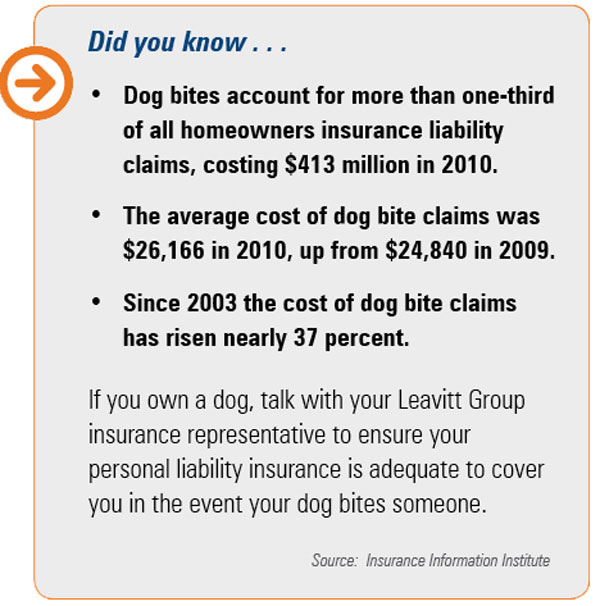

Dog Bites and Pet Disturbances

If your dog trespasses on your neighbor’s property and bites a member of that household, liability coverage will settle any medical costs that might arise.

However, this only applies to certain dog breeds since some dog species are considered high risk by insurers, hence they are not included in liability insurance coverage.

What Homeowners Liability Insurance Does Not Cover

While personal liability under homeowners insurance offers considerable protection to you and your household, this type of coverage has a few exclusions.

Apparently, personal liability does not cover everything and you should expect it to protect you from substantial claims. In some cases, you may have to top up from your own pocket if the claim surpasses the monetary limit set by the policy.

Here are some of the occurrences excluded from personal liability coverage:

Intentional damage to someone’s property

If you damage someone’s property intentionally, then your personal liability cover will not take care of the damages. You will have to pay for the repairs from your pocket.

Purposefully inflicted injury

Personal liability does not give you the license to fight with your neighbors or harm intruders. If someone files a claim for a purposefully inflicted injury, you will have to pay on your own.

Damage to one’s own property

Liability insurance only covers accidental damage to your neighbor’s property or injury to third parties within your home. Anything other than this, including damage to one’s own property, does not qualify for compensation.

Perils covered by someone else policy

Liability insurance does not cover perils like lightning and fire that are already covered using a different policy. As if that is not enough, it does not cover harm or injury to family members who already have health insurance.

Damage to a vehicle or automobile

Homeowners liability insurance does not cover damage to your vehicles or your neighbors vehicle. This is because motor vehicles already have their own auto liability insurance.

Property damage caused by a healthy tree falling

In most cases, homeowners insurance covers damage caused by falling trees. The cover will pay for any damage caused to your neighbor’s house.

However, for this cover to apply, the tree must be diseased. Liability insurance does not compensate for damages caused by a healthy tree.

Injury or property damage by the insured’s business activities

Homeowners liability insurance does not cover any damage caused by your business activities or profession. You have to acquire a different type of insurance known as home-business insurance, if you are working from home.

Bites by high-risk pets

Some dog breeds are considered high-risk, meaning they should never be allowed to be unleashed lest they intrude on your neighbor’s property.

If your high-risk dog bites your neighbor, the insurance company will not be compelled to pay for damages or injuries caused.

Claims that arise in relation to war, invasions, or insurrection

Most insurance companies do not accept claims for damages caused during war, invasions, and insurrection. This is because the effects of the war might make it impossible for the companies to remain solvent if they decide to pay everyone affected.

Harm or injury to a family member of the insured

As mentioned earlier, homeowners liability insurance does not cover your family in case of injury. This is what health insurance is meant to do!

Now that you have the correct info, run with it!

Homeowners liability insurance may not cover everything, but it might just be what you need to protect your family, household, and priceless property from unnecessary claims and lawsuits.

If you need greater liability protection against serious risks that might attract substantial settlement amounts, then consider going for a personal umbrella insurance policy.

Personal umbrella coverage provides more protection with limits of up to $1,000,000, depending on the insurer.

For help with choosing the right homeowners insurance policy, do not hesitate to contact a trusted insurance company like Old Harbor Ins. Our friendly and passionate agents will always be ready to deal with all your queries.