The reality is stark: rising non-renewals and wildfire exposure are pushing thousands of homeowners toward the FAIR Plan, where they face higher premiums paired with reduced coverage—often losing the comprehensive protection they once had.

Yet alternatives exist, accessed through independent agencies that specialize in complex, high-risk placements. Old Harbor Insurance has built its reputation on finding these alternatives, working with homeowners throughout Southern California to secure better coverage when others say it can’t be done.

Ready to explore your options? Schedule a coverage review with Old Harbor Insurance’s team and discover alternatives you didn’t know existed.

Quick Answer — What Are the Best Alternatives to the California FAIR Plan?

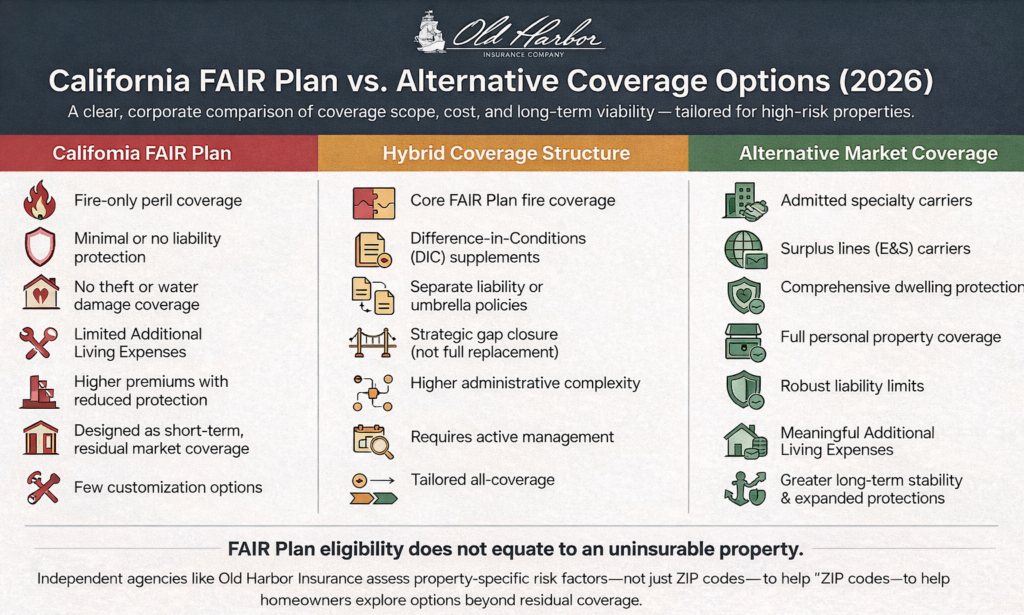

Before we dig into the details, here’s the scannable summary of your top options:

- Admitted specialty homeowners insurance carriers – Full coverage from regulated insurers still writing in wildfire zones

- Surplus lines (E&S) homeowners policies – Non-admitted but legal coverage designed for higher-risk properties

- Hybrid coverage structures – Strategic FAIR Plan usage combined with targeted supplements

- Mitigation-driven re-entry – Documentation and improvements that qualify you for voluntary market coverage

- Carrier-specific wildfire programs – Regional initiatives accessed through independent agencies with real-time market knowledge

The “best” alternative depends on your property’s specific risk profile, documentation, timeline, and budget—not just your ZIP code. That’s where an independent agency like Old Harbor Insurance becomes invaluable: they evaluate all five paths simultaneously, rather than defaulting to FAIR Plan placement because it’s easier.

Why Homeowners Are Placed on the FAIR Plan (and Why Many Don’t Have to Stay There)

The reasons homeowners land on the FAIR Plan follow familiar patterns, worn grooves in California’s insurance landscape:

Common triggers include:

- Non-renewals from standard carriers (the most common pathway)

- Location in Very High Fire Hazard Severity Zones (VHFHSZ)

- Roof type, age, or composition issues

- Vegetation management concerns or limited defensible space

- Claims history, even from years past

- Outdated construction features or building materials

- Access issues for emergency vehicles

But here’s the critical clarification that changes everything: FAIR Plan eligibility does not equal uninsurable property. Just because one carrier—or several carriers—declined your home doesn’t mean no carrier will insure it. The distinction matters.

Standard carriers and captive agents often assess risk through broad, automated criteria. They see a ZIP code in a VHFHSZ (Very High Fire Hazard Severity Zone) and stop there.

Independent agencies, conversely, reassess risk more granularly.

They look at your specific property: the Class A roof you installed last year, the defensible space you maintain religiously, the ember-resistant vents, the distance to the nearest fire station.

These details change underwriting outcomes, but only if you’re working with someone who knows which carriers care about which details.

The Old Harbor Insurance Approach to FAIR Plan Alternatives

Out in Temecula, where the vineyards meet the chaparral and the Santa Ana winds blow hot each October, Old Harbor Insurance has spent over a decade learning which doors still open when others have closed.

As an independent, multi-carrier agency, Old Harbor isn’t tied to any single insurer’s appetite or guidelines. This structural advantage means access to:

- Admitted carriers with stricter but navigable underwriting

- Surplus lines markets for properties standard carriers won’t touch

- Specialty wildfire-tolerant programs that few agencies even know exist

- Hybrid strategies that minimize gaps while preserving long-term options

But access alone doesn’t solve the problem. What sets Old Harbor apart is their concierge-level, education-first approach—aligned with their core promise: “Your future, protected.” This isn’t transactional policy placement. It’s strategic planning that starts with understanding your property, your budget, your timeline, and your tolerance for complexity.

The team emphasizes transparency at every step. They document what they find, explain why certain carriers declined and others didn’t, and build long-term plans rather than quick fixes. It’s the difference between being handed a FAIR Plan application and being guided through a comprehensive market analysis that might—might—end with the FAIR Plan, but only after exploring every legitimate alternative first.

Alternative #1 — Admitted Specialty Homeowners Insurance (The Preferred Outcome)

If there’s a hierarchy among alternatives—and there is—fully admitted carriers sit at the top.

What this option represents: Admitted specialty homeowners insurance means coverage from fully regulated California carriers that are still writing policies in wildfire-exposed areas, albeit with stricter underwriting than they employed five years ago. These carriers haven’t abandoned high-risk zones entirely; they’ve simply raised the bar.

Why this is the best alternative: You get comprehensive all-peril coverage, the full suite of dwelling protection, personal property coverage, liability protection, and additional living expenses if you’re displaced. You also get regulatory protections unavailable through FAIR Plan or surplus lines—the California Department of Insurance oversees admitted carriers more closely, providing consumer safeguards in claims disputes.

How Old Harbor helps: The agency matches properties to carriers based on specific criteria that vary by insurer:

- Defensible space compliance (often to greater distances than legally required)

- Class A fire-resistant roofing materials

- Ember-resistant vents and construction features

- Neighborhood density and proximity to fire protection resources

- Recent mitigation work with documentation

Old Harbor’s team uses documentation and mitigation evidence strategically, improving approval odds by presenting your property in the strongest possible underwriting light. They know which carriers prioritize which factors, and they craft submissions accordingly.

Alternative #2 — Surplus Lines (E&S) Homeowners Insurance

When admitted carriers decline, the surplus lines market becomes the next frontier—a landscape often misunderstood but entirely legitimate.

What surplus lines coverage is: These are non-admitted insurance policies, meaning the carrier isn’t licensed by the California Department of Insurance in the traditional sense. But they are legal, regulated under California’s surplus lines laws, and specifically designed for higher-risk properties that don’t fit admitted market guidelines.

When it makes sense: Surplus lines become appropriate after multiple admitted carrier declines, for properties with unique construction or exceptionally high replacement values, or as transitional coverage while mitigation work is completed. It’s also viable when you need coverage quickly and can’t wait for slower admitted market underwriting processes.

Old Harbor’s role: As a licensed surplus lines broker, Old Harbor Insurance structures these policies carefully to minimize exclusions and coverage gaps. They shop multiple surplus lines carriers, compare terms, and ensure clients understand exactly what’s covered and what isn’t. Perhaps most importantly, they monitor market conditions continuously, moving clients back to admitted markets when carriers reopen appetite or when additional mitigation improves underwriting profiles.

Alternative #3 — Hybrid Coverage Structures (When FAIR Plan Is Temporarily Necessary)

Sometimes reality doesn’t bend to preference. Some properties must use the FAIR Plan initially—but that doesn’t mean you’re stuck with only FAIR Plan protection.

The reality check: If your property has significant unmitigated risk, or if you’re in the middle of a renewal crisis with no time to shop properly, the FAIR Plan may be your immediate bridge to continuous coverage.

The smarter hybrid approach involves:

- FAIR Plan for basic fire coverage (what it does best)

- Targeted Difference in Conditions (DIC) policies—not blanket overbuying, but strategic supplements for specific gaps

- Standalone liability coverage or umbrella policies, since FAIR Plan liability limits are minimal

- Separate coverage for theft, water damage, and other perils the FAIR Plan excludes

How Old Harbor designs hybrid structures: The key is building these combinations with a clear exit strategy. Old Harbor treats hybrid coverage as temporary by design, documenting what needs to change for a transition back to comprehensive coverage. They identify which mitigation steps will most impact future underwriting, then time the remarketing effort strategically.

This prevents the trap too many homeowners fall into: staying on the FAIR Plan year after year simply because no one built a plan to leave it.

Alternative #4 — Mitigation-Driven Re-Entry Into the Voluntary Market

There’s an old truth in insurance underwriting, worn smooth by repetition but no less valid: properties don’t have to stay high-risk forever.

High-impact mitigation actions include:

- Fire-resistant roofing replacement (Class A materials, properly installed)

- Defensible space maintenance to 100+ feet, documented with photos and professional assessments

- Ember-resistant vents in eaves, attics, and crawl spaces

- Vegetation management plans with regular maintenance records

- Non-combustible fencing and deck materials near the structure

- Secondary water sources or fire suppression systems in extreme cases

Old Harbor’s consultative advantage: Not all mitigation spending is equal. Some improvements genuinely change underwriting outcomes; others waste money on low-impact upgrades that don’t move the needle with carriers. Our team identifies which specific improvements will matter to which specific carriers, preventing thousands in wasted expenditure.

Alternative #5 — Carrier-Specific Wildfire Programs & Regional Initiatives

Some opportunities don’t announce themselves with press releases.

The hidden landscape: Certain admitted carriers quietly reopen wildfire appetite through pilot programs, regional initiatives, or appetite changes that never make industry news. They might be testing new underwriting models, accepting properties in specific micro-zones, or partnering with wildfire mitigation organizations to insure previously declined homes.

Why consumers rarely see these: Direct carriers don’t advertise programs with limited capacity. Captive agents can only access their single carrier’s programs. Online comparison tools can’t track appetite shifts that happen monthly or even weekly.

Independent agencies track appetite in real time: Old Harbor Insurance maintains relationships across dozens of carriers, receiving updates on appetite changes, new programs, and underwriting guideline modifications. Their regional expertise in Southern California provides additional advantages—they understand local markets, know which carriers are actively writing in which neighborhoods, and recognize when a property might fit newly opened appetite.

This institutional knowledge is impossible to replicate through online research or direct carrier shopping. It’s accumulated through years of placements, carrier relationships, and dedicated market monitoring.

How to Choose the Right Alternative to the California FAIR Plan

The decision framework comes down to four core factors:

- Property risk profile: What makes your property high-risk, and can those factors be addressed? A property with Class A roofing and 100 feet of defensible space in a VHFHSZ has different options than an older home with wood shake roofing and heavy vegetation.

- Budget vs. coverage tolerance: Are you willing to pay more for comprehensive admitted coverage, or does your budget require exploring surplus lines or hybrid structures first?

- Timeline: Do you have 90-120 days to shop properly, or are you facing an immediate renewal deadline? Urgent timelines may require bridge solutions followed by strategic remarketing later.

- Willingness to implement mitigation: Some paths require physical changes to your property. If you’re prepared to invest in mitigation—and you should be—more doors open.

This is where Old Harbor Insurance acts as strategist and advocate, not just policy seller. They evaluate all four factors simultaneously, presenting realistic options with transparent guidance about costs, coverage, and long-term implications.

When the FAIR Plan Still Makes Sense (and How to Use It Strategically)

Honesty requires acknowledgment: sometimes the FAIR Plan is the correct answer.

For truly high-risk, unmitigated properties where owners aren’t prepared to invest in improvements, the FAIR Plan provides essential fire coverage that might otherwise be unavailable. As short-term bridge coverage during transitions—selling a property, completing construction, or waiting for mitigation work to be evaluated—it serves a legitimate purpose.

The key to avoiding permanent FAIR Plan placement: Never treat it as a final destination. Use it with a plan to leave. Document what needs to change. Schedule regular remarketing attempts. Work with an independent agency that actively shops your coverage rather than auto-renewing FAIR Plan policies year after year because it’s convenient.

The FAIR Plan becomes a trap only when homeowners accept it as inevitable.

Why Working With Old Harbor Insurance Changes the Outcome

What makes the difference in these complex placements isn’t magic—it’s methodology.

Old Harbor Insurance brings multi-carrier access across all personal insurance lines, meaning they’re not searching for homeowners coverage in isolation. They’re looking at your complete insurance program, often finding leverage through bundling or cross-carrier relationships.

The concierge-level service isn’t marketing language; it’s operational reality. You work with real people in local offices, not 800-number call centers. You receive education-first guidance that explains why certain options exist and others don’t, transparently recommending the best path rather than the most convenient one for the agency.

Their proven reputation—A+ BBB rating, over 1,000 five-star reviews—reflects years of delivering on promises in California’s most challenging insurance market. When they say they’ll find alternatives to the FAIR Plan, they have a track record of doing exactly that.

Frequently Asked Questions About Alternatives to the California FAIR Plan

How do insurance companies decide whether my home truly requires the FAIR Plan?

The decision is more nuanced than most homeowners realize. Carriers don’t rely on wildfire maps alone—though those maps matter. The underwriting process typically combines multiple property-specific factors:

- Roof material and age: Class A fire-resistant roofing versus composition shingles versus wood shake makes an enormous difference. Age matters too; a 25-year-old Class A roof raises more concern than a three-year-old one.

- Defensible space compliance: Carriers increasingly evaluate this in zones—the critical 0-5 feet immediately around your home, the 5-30 foot buffer zone, and the extended 30-100 foot area. Documentation of maintenance in each zone strengthens your position.

- Road access and turnaround clearance: Can fire equipment reach your property and turn around safely? Narrow driveways, steep grades, or dead-end roads with insufficient turnaround space raise red flags.

- Proximity to hydrants and fire stations: Distance to the nearest fire station, hydrant locations, and response times all factor into risk calculations. Properties with nearby hydrants and short emergency response times have better odds.

- Construction year and ignition-resistant features: Homes built after California updated building codes (particularly post-2008 in VHFHSZ areas) often incorporate ember-resistant vents, tempered glass, and other features that reduce ignition risk.

Here’s what changes outcomes: homes declined by one carrier may still qualify with another that weights these factors differently. One carrier might automatically decline all VHFHSZ properties. Another might accept them with Class A roofing and documented defensible space. A third might require all that plus proximity to a fire station within five miles.

This variance is precisely why independent agencies like Old Harbor Insurance often succeed where direct carriers fail—they know which specific factors matter to which specific carriers, and they present properties accordingly.

Is being in a “Very High Fire Hazard Severity Zone” an automatic FAIR Plan requirement?

No, and this misconception costs homeowners better coverage every day.

VHFHSZ designation raises scrutiny, certainly. Underwriters pay closer attention. Guidelines tighten. But it does not automatically disqualify a property from traditional insurance. Many admitted and surplus lines carriers still actively write policies in VHFHSZ areas if the home demonstrates strong mitigation and access characteristics.

The challenge is that ZIP-code-only declines are increasingly common—automated underwriting systems see a high-risk zone and decline the property before human review. But these automated declines are not universal across the market. Other carriers use more sophisticated risk assessment that looks beyond geography to property-specific factors.

Think of it this way: VHFHSZ designation determines which carriers you can access, not whether you can access any carrier at all. The pool of options shrinks, but it doesn’t disappear entirely. Success requires knowing which carriers still have appetite for well-maintained properties in these zones and how to present your specific property in the strongest underwriting light.

Why do two homes on the same street receive completely different insurance outcomes?

Walk down any street in wildfire country and you’ll find this paradox repeatedly: identical floor plans, similar lot sizes, same fire risk zone—yet one homeowner has comprehensive admitted coverage while their neighbor is on the FAIR Plan paying more for less protection.

Underwriters assess property-level variables, not just location. Differences that often matter include:

- One roof replaced with Class A materials, the other not: Even a two-year difference in roof replacement timing can change outcomes entirely.

- Vegetation clearance inconsistencies: One homeowner maintains defensible space religiously and documents it. The neighbor has let vegetation creep closer to the structure or hasn’t cleared dead brush from their property.

- Driveway width or slope: One property has a standard 12-foot-wide driveway with moderate grade. The neighbor’s narrow, steep driveway raises access concerns.

- Updated versus legacy construction features: One home had ember-resistant vents installed during a renovation. The other retains original construction details from the 1970s.

These small differences—individually minor, collectively decisive—can shift a property from FAIR Plan placement to admitted or even surplus coverage. It’s frustrating for homeowners who see their situation as identical to their neighbor’s, but it underscores why property-specific evaluation matters so much in high-risk zones.

When Old Harbor Insurance evaluates a property, they’re specifically identifying which differences will matter to which carriers—helping homeowners understand what might seem like inexplicable variance in outcomes.

Can mitigation improvements actually lower my insurance cost—or just help me qualify?

Both, but the impacts are uneven and often misunderstood.

Qualification impact: High (often decisive)

Mitigation improvements frequently make the difference between FAIR Plan placement and admitted coverage, or between no coverage offers and multiple options. This is where the real value lies—not in premium reduction, but in market access.

Premium reduction: Moderate and carrier-dependent

Once you qualify for coverage, some carriers offer modest discounts for specific mitigation measures (typically 5-15% for things like Class A roofing or defensible space compliance). But premium reduction is secondary to the qualification benefit.

Here’s the economic reality: a homeowner paying $8,000 annually on the FAIR Plan plus DIC coverage who invests $15,000 in a Class A roof replacement might subsequently qualify for $4,500 admitted coverage. The savings isn’t from a discount on the FAIR Plan—it’s from accessing a completely different market with better coverage at lower cost. The roof investment pays for itself in under four years, and the homeowner gains comprehensive protection in the process.

The real value is unlocking access to carriers that offer full coverage. Some upgrades (roof replacement, defensible space documentation) provide outsized underwriting leverage compared to their cost. Others (cosmetic improvements, minor landscaping changes) cost money without materially affecting carrier appetite.

This is where guidance matters. Old Harbor’s team helps homeowners prioritize mitigation spending toward improvements that actually change underwriting outcomes, not just general property upgrades.

How long does it usually take to exit the FAIR Plan once improvements are made?

The timeline surprises most homeowners—it’s shorter than expected when done properly.

Many homeowners transition off the FAIR Plan within one renewal cycle (6-12 months) after completing key mitigation steps. Some move even sooner if documentation is strong and market timing aligns. There is no mandatory waiting period; eligibility depends on underwriting acceptance, not time served on the FAIR Plan.

Here’s what affects timeline:

Fast transitions (3-6 months): Completed roof replacement, documented defensible space, clean claims history, good market timing, and proactive shopping with strong documentation.

Standard transitions (6-12 months): Most mitigation completed, waiting for seasonal vegetation management to demonstrate ongoing maintenance, or shopping during annual renewal cycle.

Longer transitions (12-24 months): Multiple improvements needed, recent claims requiring time to age off, or market conditions requiring patience for carrier appetite to reopen.

The single biggest factor affecting timeline is when you start. Homeowners who begin the process 90-120 days before renewal have dramatically better outcomes than those who wait until 30 days before. The former have time to complete mitigation, document improvements, and shop thoroughly. The latter face crisis-mode decisions with limited options.

Are surplus lines insurance policies safe if the carrier isn’t “admitted”?

Yes—when structured properly and purchased through knowledgeable agents who understand the distinction.

The “non-admitted” terminology frightens some homeowners unnecessarily. Here’s what it actually means:

Surplus lines carriers are legally regulated under California Insurance Code but not rate-controlled by the Department of Insurance. They operate under different oversight designed specifically for their role insuring complex or high-risk properties that admitted carriers won’t touch. They’re not unregulated; they’re differently regulated.

What surplus lines carriers may lack is state guarantee fund protection. If an admitted carrier fails, the California Insurance Guarantee Association provides coverage for certain claims. Surplus lines carriers don’t participate in this fund, meaning policyholders have no state backstop if the carrier becomes insolvent.

This makes three factors especially important:

- Carrier financial strength ratings: Work with surplus lines carriers that maintain strong ratings (A- or better from AM Best).

- Policy wording and coverage design: Surplus lines policies can be more customized—which is good—but can also have unusual exclusions or limitations. Professional review of policy terms matters more than with standard admitted policies.

- Professional oversight: This isn’t the place to shop purely on price. Surplus lines placement requires understanding of non-standard markets, policy construction, and carrier selection.

Old Harbor Insurance evaluates surplus lines carriers carefully, verifying financial stability and policy terms before recommending placement. The goal is ensuring clients understand exactly what protection they’re purchasing and from whom.

Why didn’t my previous agent show me these FAIR Plan alternatives?

The answer is usually structural, not intentional.

Many agents face constraints that prevent them from exploring FAIR Plan alternatives effectively:

Captive agents work for a single carrier. If that carrier declines your property, they have nothing else to offer. They’re not withholding alternatives—they genuinely don’t have access to other markets.

Many independent agents lack surplus lines licenses. Surplus lines placement requires separate licensing and compliance. Agents without this licensing can’t access non-admitted markets regardless of whether those markets would accept your property.

Complex underwriting placements require specialized knowledge and carrier relationships. Some independent agents focus on standard market placements where underwriting is straightforward. High-risk property placement demands different expertise, carrier contacts, and market knowledge.

Defaulting to FAIR Plan is the fastest solution. When an agent is busy and a property seems difficult to place, referring to the FAIR Plan resolves the immediate problem quickly. Exploring alternatives requires time, multiple carrier submissions, documentation gathering, and follow-up—work that some agents simply won’t invest.

Exploring alternatives requires time, carrier access, and underwriting strategy, not just quoting software. It’s the difference between taking an application and solving a puzzle. Not all agents have the tools, knowledge, or inclination to solve complex placement puzzles.

If your previous agent immediately referred you to the FAIR Plan without discussing alternatives, they likely lacked the structural ability to pursue other options—not necessarily the willingness.

Is it ever smarter to stay on the FAIR Plan temporarily instead of switching immediately?

Absolutely. Strategic thinking sometimes means short-term FAIR Plan placement with a clear exit plan.

Situations where temporary FAIR Plan placement makes sense include:

When mitigation work is underway but not yet complete: If you’re replacing your roof in two months, waiting to shop until after completion may yield better offers than shopping now with an aging roof.

When surplus pricing is temporarily inflated: Surplus lines pricing can spike after major wildfire events as carriers reassess risk. Sometimes waiting 6-12 months for markets to stabilize yields better long-term value than locking into inflated pricing immediately.

When admitted carriers are expected to reopen appetite: Carrier appetite changes. If your agent knows a specific carrier is piloting a new wildfire program or reopening appetite in your area in the next quarter, waiting strategically might provide access to superior coverage.

When your renewal deadline doesn’t allow adequate shopping time: If you’re 30 days from renewal with no current alternatives identified, starting with FAIR Plan while simultaneously working on a comprehensive long-term strategy prevents coverage gaps.

In these cases, a short-term FAIR Plan strategy paired with a documented exit plan can be more cost-effective than rushing into inferior long-term coverage. The key phrase is “documented exit plan.” You’re not accepting FAIR Plan placement as permanent—you’re using it strategically while actively working toward better alternatives.

Old Harbor Insurance designs these temporary placements deliberately, with clear timelines and trigger points for remarketing. It’s strategic patience, not resignation.