If something happened to you tomorrow, would your family be financially secure? It’s a difficult question, but an important one. Life insurance isn’t morbid—it’s one of the most caring decisions you can make for the people who depend on you. At Old Harbor Insurance, we’ve helped many Jurupa Valley families find coverage that protects their loved ones and fits their budget. This guide walks you through your options so you can choose confidently for your family’s future.

Here’s what might surprise you: life insurance is more affordable than you think, and finding the right policy doesn’t have to be complicated. Whether you’re looking for basic protection or something with more flexibility, there’s a solution that’s right for your situation. By the end of this article, you’ll understand the different types of life insurance available and exactly how to choose the one that makes sense for you.

Why Life Insurance Matters for Your Family

Life insurance is about protecting your family if the unexpected happens. For primary earners, it replaces lost income and helps cover everyday expenses, mortgage payments, and other obligations. According to the U.S. Social Security Administration, life insurance plays a key role in income replacement and maintaining family financial security when a wage earner is no longer there.

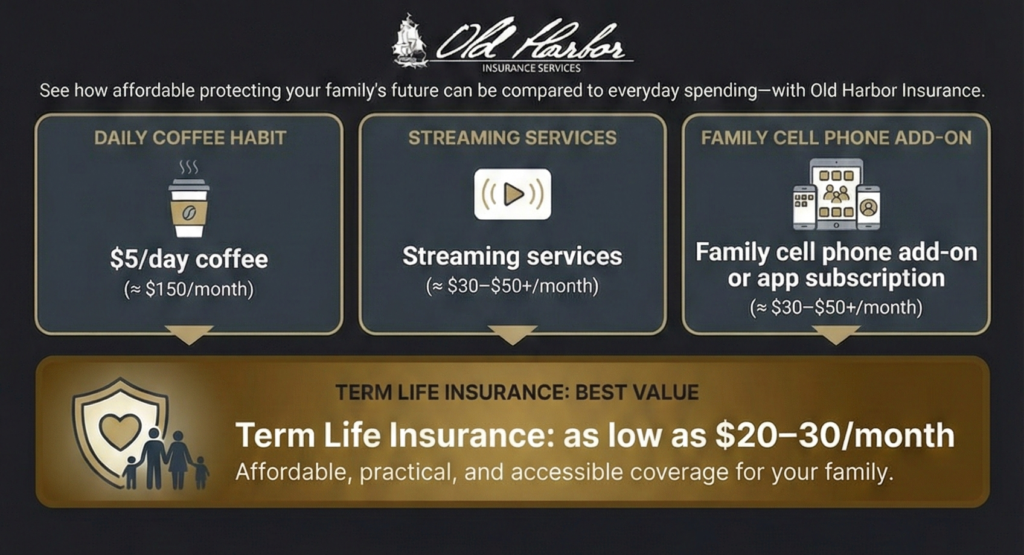

Many Jurupa Valley families put off getting life insurance because they think it’s expensive or complicated. The truth is, term life insurance can cost as little as $20-30 per month for solid coverage. That’s incredibly affordable protection for the peace of mind it brings. Whether you’re protecting your family’s income, securing your kids’ education, paying off debt, or covering final expenses, life insurance is the safety net that makes all of that possible.

Understanding Your Life Insurance Options

Life insurance comes in several flavors, and the right one depends on your specific situation, budget, and what you’re trying to protect. According to the National Association of Insurance Commissioners, understanding the different types of coverage available is the first step toward making an informed decision. Let’s break down the main types so you can see which one fits your needs best.

Term Life Insurance: Affordable and Straightforward

Term life insurance provides coverage for a set period—often 10, 20, or 30 years—in exchange for a monthly premium. If you pass away during the term, your beneficiaries receive the death benefit; if not, coverage ends. With no cash value component, term life offers maximum protection at a lower cost, making it ideal for families with young children or significant debt.

Whole Life Insurance: Lifelong Coverage with Cash Value

Whole life insurance provides coverage for your entire lifetime, not just a specific term. Your premiums stay fixed, and the policy builds cash value over time—money you can actually borrow against if needed. It’s more expensive than term insurance, but you’re paying for permanence and flexibility. Whole life is ideal if you want coverage that lasts your entire life and the security of a policy with guaranteed value.

Universal Life Insurance: Flexibility When Life Changes

Universal life insurance (UL) sits between term and whole life—it offers permanent coverage with the flexibility to adjust your premiums and death benefit as your life changes. You get a guaranteed death benefit without the rigid structure of whole life, and you have more control over how your money works. Universal life is great if you want permanence without sacrificing flexibility, or if your financial situation might change over time.

Universal Life Insurance: Flexibility When You Need It

Universal life insurance deserves a closer look because it solves a real problem many families face: what happens when your needs change? Maybe your kids grow up, your mortgage gets paid down, or your income increases. Universal life lets you adjust your coverage to match your life, not the other way around.

With universal life, you have a guaranteed death benefit that protects your family no matter what. But unlike whole life, you’re not locked into fixed premiums or a fixed death benefit amount. Need to lower your payment for a year? You can do that. Want to increase your coverage as your wealth grows?

Universal life gives you that option. The American Council of Life Insurers highlights how universal life policies provide the flexibility families need as their circumstances evolve. It’s permanent protection with the flexibility you actually need.

How to Choose the Right Coverage for Your Situation

Choosing between term, whole, and universal life comes down to three questions: how long you need coverage, your budget, and how much flexibility you want. If you’re young with children and a mortgage, term life often provides strong protection at a lower cost. For lifelong coverage, whole or universal life may be a better fit, while universal life offers added flexibility as your needs change.

The amount of coverage you need depends on your specific situation. According to the Life Insurance Marketing and Research Association, a good rule of thumb is 8-10 times your annual income, but that varies based on your debts, dependents, and financial goals. The best move is to talk with an insurance professional who can look at your whole picture and recommend coverage that actually fits your life.

How Old Harbor Insurance Helps Jurupa Valley Families

At Old Harbor Insurance, we understand that life insurance isn’t one-size-fits-all. We take time to understand your family’s situation, your goals, and your concerns—and then we recommend coverage that actually makes sense for you. We don’t push the most expensive option; we find the right option for your budget and needs.

We work with A-Rated insurance carriers that are financially sound and stable, so you know your family’s death benefit will be paid when it matters most. Our licensed agents in the Jurupa Valley area are real people who care about your family’s security, not just making a sale. We’re here to answer your questions, address your concerns, and make this process as straightforward as possible.

Protect Your Family’s Future Today

Life insurance is one of the most important decisions you’ll make for your family’s future—and it doesn’t have to be complicated or expensive. Whether you choose term, whole, or universal life insurance, the key is getting the right coverage that fits your situation and gives you peace of mind.

The team at Old Harbor Insurance is ready to help you navigate your options and find the perfect policy for your Jurupa Valley family. Getting started is easy: call us at (951) 297-9740, email info@oldharbor.com, or fill out a quick quote form on our website. One of our licensed agents will contact you within 24 hours to discuss your needs and answer any questions. Your family’s financial security is worth protecting today.

FAQs

What’s the difference between term and whole life insurance?

Term life covers you for a specific period (like 20 years) at a low cost, but coverage ends when the term is up. Whole life covers you for your entire lifetime at a higher cost, and it builds cash value. Choose term if you want affordable protection for a specific period; choose whole life if you want permanent coverage with guaranteed value.

Can I change my life insurance coverage later?

Absolutely. Life circumstances change, and your coverage can change too. Many policies can be converted or adjusted, and you can always add additional coverage as your needs grow. Universal life specifically gives you the flexibility to adjust premiums and death benefits without getting a whole new policy.

What medical information do I need to provide?

Depending on the coverage amount, you may need to answer health questions or get a medical exam. Universal life and whole life policies might require more information than term policies because they’re permanent coverage. Our agents can walk you through exactly what to expect.

Do I need life insurance if I’m self-employed?

Yes—and it’s often more important. Self-employed individuals don’t have employer-provided coverage, so protecting your income and your family’s financial security falls entirely on you. Life insurance ensures your family can maintain their lifestyle if something happens to you.

How long does it take to get life insurance?

It depends on the coverage amount and your health situation. Some term policies can be approved in days; larger policies or permanent coverage might take 2-4 weeks due to medical underwriting. Our team will give you a realistic timeline during the quote process.

How much life insurance coverage do I actually need?

There’s no one-size-fits-all answer, but a common starting point is coverage equal to 8-10 times your annual income. However, you should also factor in outstanding debts, mortgage balance, education costs for children, and final expenses. We recommend working with an agent to calculate your specific needs based on your family’s situation.

What’s the difference between universal life and whole life insurance?

Both provide permanent, lifelong coverage, but universal life offers more flexibility. With whole life, premiums and death benefits are fixed. With universal life, you can adjust premiums and death benefits as your circumstances change. Universal life is ideal if you want permanence with adaptability, while whole life is better if you prefer predictability and guaranteed structure.