You may have noticed how life insurance quotes vary widely for similar coverage—one person might pay $40 a month while another pays $60. That difference comes from carrier pricing, not coincidence. At Old Harbor Insurance, we work with multiple A-rated carriers, giving Orange County families access to options and rates that captive agents often can’t offer.

If you’ve been shopping around and feeling overwhelmed by different quotes and confusing comparisons, there’s a better way. In this guide, we’ll show you exactly how an independent agent finds better rates and why working with someone local in Orange County actually saves you money. By the end, you’ll understand the pricing game insurance companies play—and how to win it.

The Rate Comparison Problem Most People Face

Many Orange County residents compare life insurance options by using online quote tools, but these platforms typically display rates from only one or two carriers. Without access to a broader market, you may never see better options from the dozens of other insurers that could offer stronger coverage at a lower cost.

Here’s what many people don’t realize: according to the National Association of Insurance Commissioners, life insurance pricing varies by an average of 30-50% between carriers for identical coverage. That means the quote you receive online might cost you $50+ more per month than what another carrier would charge. Over 20 years, that’s an extra $12,000+ you’re paying for absolutely nothing extra.

Why Independent Agents Have Access to Better Rates

The independent agent advantage isn’t just marketing talk—it’s a fundamental structural difference in how insurance works. When you work with a captive agent at State Farm or Allstate, that agent can only quote you that one company’s rates. They can’t compare your application across multiple carriers to find the best fit.

An independent agent like Old Harbor Insurance does exactly that. We maintain active relationships with 81 insurance carriers, many of them A-Rated insurers that don’t sell directly to the public. This gives Orange County residents access to premium options they wouldn’t find on their own—whether a carrier favors a certain age group, business owners, or specific health profiles.

How Multiple Quotes Improve Your Coverage Options

When you apply with us, your application is submitted to multiple carriers at once, generating several quotes. We compare not only pricing, but also coverage features, underwriting speed, and carrier stability—because the lowest price isn’t always the best overall fit.

How the Underwriting Process Works (And Why It Affects Your Rate)

Here’s something most people don’t realize: your life insurance rate isn’t based on age and health alone. It also depends on how thoroughly an insurance company underwrites your application and what that process uncovers.

Research from the American Council of Life Insurers shows that carriers apply different underwriting standards, which means the same applicant can receive different rates from different companies. Some insurers require full medical exams and detailed health records for larger policies, while others use accelerated underwriting based on MIB records and prescription databases.

How Carrier Underwriting Differences Impact Your Final Rate

An independent agent knows which carriers offer faster underwriting for your situation and which are more likely to approve you at the best rate. For example, one carrier may apply a surcharge for controlled high blood pressure, while another that specializes in managed chronic conditions may not. A captive agent doesn’t have the flexibility to make that comparison.

Orange County’s Unique Insurance Landscape

Orange County’s higher cost of living often means larger financial obligations, which can support higher life insurance coverage amounts and, in some cases, better per-unit pricing. The area also has a strong professional and business-owner population, and some carriers offer specialized programs with favorable terms for business-related life insurance needs.

Southern California’s competitive insurance market further benefits consumers who work with independent agents. With carriers actively competing for market share, strategic shopping helps secure stronger pricing and coverage options for Orange County clients.

How Old Harbor Insurance Finds You Better Rates

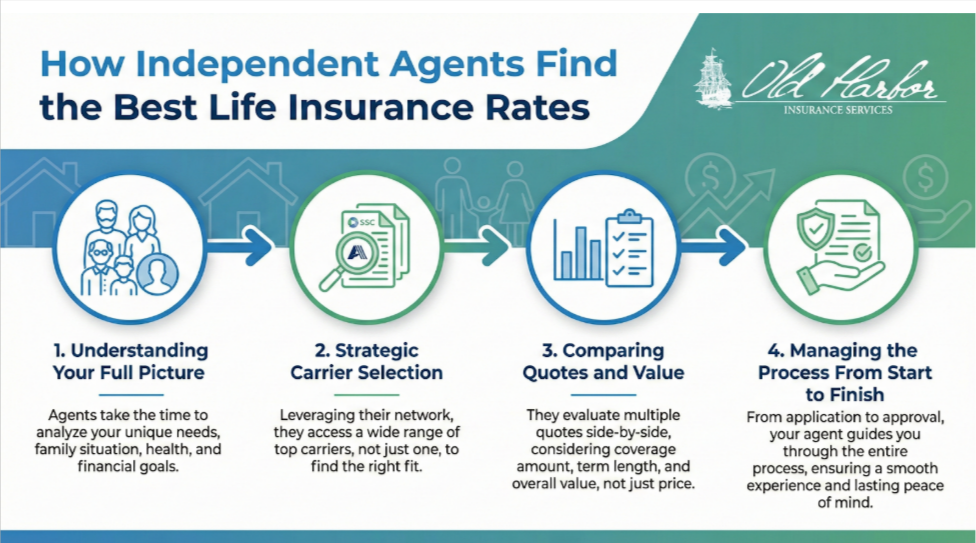

Step 1: Understanding Your Full Picture

Our process starts with listening. We take time to understand your age, health, income, family situation, and financial goals—focusing on what you’re protecting and why, not just completing an application.

Step 2: Strategic Carrier Selection

We identify 5–15 carriers most likely to offer competitive rates for your profile. Rather than submitting to every carrier, we focus on those whose underwriting approach and pricing align with your situation.

Step 3: Comparing Quotes and Value

After submitting your application, carriers typically respond within 3–5 business days, with some offering faster turnaround. We review each quote carefully, evaluating not just price, but underwriting speed, company stability, and coverage features to identify the best overall value.

Step 4: Managing the Process From Start to Finish

Once you select a carrier and coverage amount, we handle all paperwork and guide your application through underwriting. If additional information is needed, we manage the communication and advocate for you throughout the process.

How Old Harbor Insurance Helps Orange County Families

At Old Harbor Insurance, we’re not just finding you lower rates—we’re building a relationship with you as your life insurance professional. Orange County is our home, and we understand the specific financial pressures and opportunities residents face. We know that a small difference in monthly premium might not sound important until you realize it compounds to thousands of dollars saved over the life of your policy.

We also understand that life changes. The coverage you need at 35 with young kids is different from what you need at 45 when those kids are independent. We don’t just sell you a policy and disappear—we check in periodically to make sure your coverage still matches your life. If circumstances change, we help you adjust without paying unnecessary fees or penalties.

Protect What You’ve Built Today

The difference between finding the right rate and settling for the first quote you get could be hundreds or thousands of dollars over the life of your policy. Life insurance is too important—and too affordable—to leave money on the table by working with someone who can only show you one carrier’s options.

Old Harbor Insurance is ready to shop your application across our network of 81 carriers and find you the best rate available. Getting started is simple: call us at (951) 297-9740, email info@oldharbor.com, or fill out a quick quote form on our website. One of our licensed agents will contact you within 24 hours to discuss your needs and start the rate comparison process. Your best rate is waiting—let’s find it together.

FAQs

Why do life insurance rates vary so much between carriers?

Carriers use different underwriting models, mortality tables, and risk assessment strategies. They also have different business strategies—some price aggressively to gain market share, others focus on profitability. This results in rate variations of 30-50% for identical coverage.

Can’t I just compare quotes online and get the same rates as an independent agent?

Online quote engines typically only represent 1-2 carriers, so you’re not seeing 80+ options. Additionally, many of the best carriers don’t sell directly to consumers or through online aggregators—they only work with independent agents. You’re missing out on numerous rate options by relying solely on online quotes.

How long does it take to get quotes from multiple carriers?

Most carriers respond within 3-5 business days, though some use accelerated underwriting and respond within 24-48 hours. The entire process from application to final decision typically takes 1-2 weeks, depending on how quickly you provide any additional information the carriers request.

Do I need a medical exam for life insurance?

It depends on the coverage amount and your health profile. Some carriers offer policies up to certain amounts without requiring medical exams. Others might require bloodwork or a full exam for larger policies. An independent agent knows which carriers have exam-free options that match your coverage needs.

What happens if I’m denied coverage by one carrier?

Being declined by one carrier doesn’t mean you’re uninsurable. Different carriers have different underwriting standards, and another carrier might approve you at standard or even preferred rates. This is another major advantage of working with an independent agent—if one carrier declines you, we know which other carriers are more likely to approve your application.

How do independent agents make money?

Independent agents earn commissions from insurance carriers when you purchase a policy. The commission is the same regardless of which carrier you choose, so we have no financial incentive to recommend one carrier over another—we’re genuinely motivated to find you the best rate and coverage. We make money when you’re happy with your policy.

Can I switch life insurance policies if I find a better rate later?

Yes, you can switch policies at any time. However, if your health has changed since you got your original policy, you might receive different rates or underwriting results. It’s worth reviewing your coverage every few years and shopping around, which is something Old Harbor Insurance recommends for all clients.

Why should I work with a local agent instead of online?

Local agents provide personalized service, can answer complex questions over the phone, and have relationships with multiple carriers. According to the Life Insurance Marketing and Research Association, customers who work with local agents report higher satisfaction and better long-term policy outcomes than those who rely on online-only options. You also have a real person you can contact if issues arise.