The letter arrives with the weight of inevitability—a notice of non-renewal from your insurance carrier, clinical in its language, devastating in its implications.

For tens of thousands of California homeowners, this scenario has shifted from remote possibility to lived reality. The state’s insurance market, battered by catastrophic wildfire losses and climate uncertainty, has entered a period of profound disruption that leaves property owners scrambling for coverage in an increasingly inhospitable landscape.

If you’re facing cancellation or simply want to explore your options with an independent broker who represents multiple carriers, Old Harbor Insurance serves California homeowners with access to coverage solutions beyond what single-carrier agents can offer.

What to Do Immediately When You Receive a Cancellation Notice

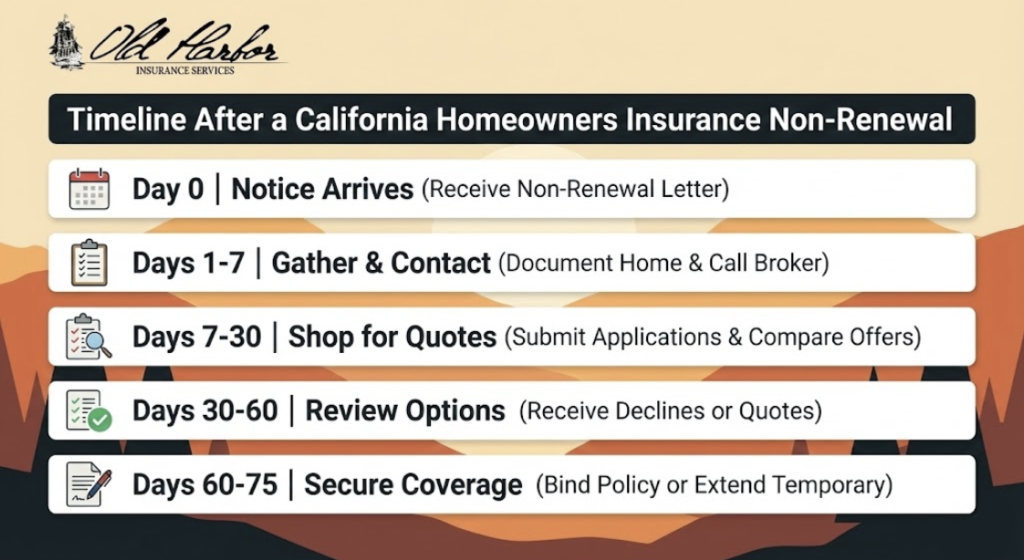

The notice itself typically arrives 75 days before your policy’s expiration date—California law requires this minimum notification period for non-renewal. This narrow window demands immediate action.

Contact your current insurer first to confirm the cancellation is final and understand the specific reason. Occasionally, administrative errors occur, or the insurer might reconsider if you can demonstrate risk mitigation measures you’ve implemented. While unlikely to reverse their decision, this conversation at least provides documentation and clarity.

Begin shopping for replacement coverage within 48 hours of receiving the notice. The California insurance market has become so constrained that finding replacement coverage can take weeks or months, not days. Independent insurance brokers like Old Harbor Insurance maintain relationships with dozens of carriers and can simultaneously quote your property across multiple markets—a significant advantage over captive agents who represent only one insurer.

Document your home’s protective features before beginning the quote process. Homes with Class A fire-resistant roofing, ember-resistant vents, multi-pane windows, defensible space clearance, and fire-resistant siding qualify for better rates and face lower declination rates. Gather photographs, receipts for upgrades, and any fire mitigation work documentation. These materials can mean the difference between coverage and rejection.

Avoid coverage lapses at all costs. Beyond the legal requirement to maintain homeowners insurance if you have a mortgage, even brief coverage gaps create cascading problems. Future insurers view gaps as red flags and often charge significantly higher premiums or decline coverage entirely. Lenders will force-place expensive coverage if your policy lapses. If your current coverage expires before you secure replacement coverage, request a short-term extension even at higher cost.

Your Coverage Options After Cancellation

California homeowners facing non-renewal have three primary paths forward, each with distinct trade-offs:

Standard Market Coverage

The ideal outcome—securing replacement coverage through the admitted insurance market—has become increasingly difficult but remains possible for well-maintained homes in moderate-risk areas. Success factors include:

Property location outside extreme wildfire hazard zones dramatically improves your odds. Homes in urban areas, coastal regions with lower fire risk, or properties with substantial defensible space and modern fire hardening can still attract multiple quotes from standard carriers.

Working with independent agents proves crucial here. Old Harbor Insurance’s multi-carrier platform allows simultaneous submission to carriers actively writing in California, including regional specialists who may accept properties that national carriers decline. While State Farm and Allstate have pulled back, dozens of smaller carriers continue writing select business.

Premium expectations require adjustment. Standard market replacement coverage typically costs 30-50% more than your cancelled policy carried, reflecting the market’s general repricing of California wildfire exposure. Annual premiums of $3,000-$5,000 for homes previously insured at $1,800-$2,200 have become common.

Surplus Lines (Non-Admitted) Coverage

When admitted carriers decline coverage, California’s robust surplus lines market provides alternatives. These non-admitted insurers operate with fewer regulatory constraints but also fewer consumer protections:

Surplus lines carriers can price risk more dynamically and accept properties that standard carriers deem too hazardous. However, policies lack the California Insurance Guarantee Association backing that protects policyholders if an admitted carrier becomes insolvent.

Coverage tends to be more restrictive with higher deductibles, lower coverage limits for certain perils, and sometimes reduced replacement cost guarantees. Read these policies carefully—not all coverage is created equal.

Premiums run 40-70% higher than comparable admitted market coverage, with some homeowners paying $6,000-$10,000 annually for properties previously insured at $2,000-$3,000. For homes in high-risk areas where no admitted carrier will write coverage, however, surplus lines represent the only alternative to the FAIR Plan.

California FAIR Plan

The state’s insurer of last resort provides basic fire coverage when no private insurer will accept your property. Understanding the FAIR Plan’s limitations helps set appropriate expectations:

Coverage is bare-bones. The FAIR Plan provides dwelling coverage only—no liability protection, no personal property coverage, no additional living expenses if your home becomes uninhabitable. You’ll need separate policies for these exposures, creating complexity and additional cost.

Premiums aren’t the bargain they once were. Recent rate increases pushed FAIR Plan premiums closer to standard market pricing for many homes. Annual costs of $2,500-$4,000 have become typical, though this only covers the dwelling itself.

Coverage limits max out at amounts that may not fully protect higher-value homes. The FAIR Plan’s $3 million maximum dwelling coverage leaves owners of expensive properties partially uninsured, forcing them to either accept reduced protection or layer additional surplus lines coverage on top of the FAIR Plan policy.

Strategies to Improve Your Coverage Options

Even after cancellation, homeowners can take concrete steps to improve their insurability and potentially secure better coverage:

Fire hardening upgrades provide the highest return on investment for improving insurability. Class A roofing, ember-resistant vents, enclosed eaves, and multi-pane windows all reduce your home’s vulnerability to wildfire and make it more attractive to insurers. California’s Safer from Wildfires regulations, effective since 2023, establish minimum standards for new construction that also serve as useful guidelines for retrofit priorities on existing homes.

Defensible space maintenance around your property signals risk awareness to insurers. California law requires 100 feet of defensible space around homes in wildfire-prone areas, divided into zones with specific vegetation management requirements. Document your compliance with photographs and maintenance records—many insurers now require this evidence before binding coverage.

Claims history management matters more than ever. Even one small claim can trigger non-renewal in today’s market. Consider paying for minor damage out of pocket rather than filing claims, reserving your insurance for truly catastrophic losses. Some insurers now offer premium credits for claim-free years, acknowledging that policyholders who don’t file claims subsidize those who do.

How an Independent Broker Changes Your Odds

The distinction between captive agents (who represent one insurer) and independent brokers (who represent multiple carriers) has never mattered more than in today’s constricted California market:

Market access determines whether you’ll find coverage at all. Independent brokers maintain appointments with dozens of carriers—regional specialists, surplus lines markets, niche insurers focusing on specific property types. When one carrier declines your property, an independent broker immediately moves to the next option without requiring you to start the process over with a new agent.

Old Harbor Insurance’s platform connects California homeowners with carriers actively writing in the state, including options unavailable through single-carrier agents. Their A+ BBB rating and decade-plus operating history in Southern California provide the stability that matters when you’re trying to secure long-term coverage, not just a one-year policy that gets non-renewed.

Negotiating leverage improves when brokers bring volume to carriers. Insurers maintain capacity for properties they’d decline if approached individually, reserving this capacity for brokers who deliver consistent business flow. Your application submitted through a high-volume independent broker carries more weight than the same application submitted directly.

Expert guidance on coverage structuring makes the difference between adequate protection and coverage gaps that destroy your financial position after a loss. Independent brokers review your total risk exposure—dwelling coverage limits, rebuilding cost estimates, liability protection, additional living expenses—rather than simply binding whatever policy they can find. For California homeowners facing limited options, getting the coverage structure right on the first try matters enormously.

The Future of California’s Insurance Market

California regulators have proposed reforms designed to stabilize the market and encourage insurers to return. Commissioner Ricardo Lara’s proposed changes would allow carriers to use catastrophe modeling in rate setting and purchase reinsurance costs through premium rates—changes the industry has sought for years.

Whether these reforms arrive quickly enough to prevent further market deterioration remains uncertain. In the interim, California homeowners must navigate a landscape where finding coverage requires persistence, flexibility, and often professional help.

The insurance crisis isn’t going away quickly. Even with regulatory reform, climate change continues driving increased wildfire frequency and severity. Homeowners in high-risk areas should prepare for a future where coverage remains expensive and options limited, while those in moderate-risk zones may see gradual market improvement as carriers regain confidence in their ability to price risk accurately.

Contacting an independent insurance broker like Old Harbor Insurance provides access to the full range of California coverage options, from standard admitted carriers to surplus lines specialists to FAIR Plan gap coverage. Their team understands the current market dynamics and can navigate the complexity on your behalf.

Frequently Asked Questions

Can my insurance company cancel my policy mid-term, or only at renewal?

California insurers generally cannot cancel your homeowners insurance mid-term except for specific reasons: non-payment of premiums, fraud or material misrepresentation on your application, or significant increase in risk (like starting a home business with hazardous materials).

Most “cancellations” California homeowners experience are actually non-renewals—the insurer declines to renew your policy when it expires but honors coverage through the policy term. The 75-day advance notice requirement applies to non-renewals, giving you time to find replacement coverage before your current policy ends.

Will I be forced onto the FAIR Plan if no private insurer will accept my property?

The FAIR Plan functions as California’s insurer of last resort, available to any property owner who can demonstrate they’ve been declined by at least one admitted carrier. However, you’re not automatically “forced” onto the FAIR Plan—it’s an option you can choose if private market coverage isn’t available.

Many homeowners explore surplus lines coverage first, as these non-admitted carriers may offer more comprehensive protection than the FAIR Plan’s basic fire coverage, albeit at higher premiums. Working with an independent broker helps you compare all available options before defaulting to the FAIR Plan.

How much more expensive will my replacement coverage be after cancellation?

Replacement coverage costs vary dramatically based on your property’s location, construction, and fire risk profile. Homeowners in moderate-risk areas might see premium increases of 30-50% when moving to new admitted carriers.

Those requiring surplus lines coverage should anticipate 50-100% premium increases, with some high-risk properties seeing costs double or triple. FAIR Plan coverage combined with separate liability and personal property policies typically costs 40-70% more than traditional comprehensive homeowners insurance previously cost. The market continues repricing California wildfire risk, so expect additional increases over the next several years regardless of which coverage option you choose.

Can I challenge my insurer’s decision not to renew my policy?

California law grants insurers broad discretion to non-renew policies at expiration, provided they give proper notice. You cannot force an insurer to renew coverage they’ve declined. However, you can verify they followed proper procedure—ensuring they provided the required 75-day notice, properly documented their decision, and applied their underwriting guidelines consistently.

If you believe the non-renewal was discriminatory or violated California insurance regulations, you can file a complaint with the California Department of Insurance. The department won’t force your insurer to renew your policy, but they can investigate improper practices and potentially help you understand your rights and options.

What happens if my homeowners insurance lapses because I can’t find replacement coverage?

Coverage lapses create serious problems. If you have a mortgage, your lender will force-place expensive coverage to protect their interest—typically 2-3 times what standard homeowners insurance costs, with bare-bones protection that may not adequately cover your own needs. Future insurers view coverage gaps as red flags, often declining applications or charging significantly higher premiums to homeowners with lapse history.

You’ll also be personally exposed to liability claims and property loss during any uninsured period. If you’re approaching your cancellation date without secured replacement coverage, contact your current insurer immediately to request a short-term extension while you continue shopping. Most carriers will grant brief extensions at higher premiums to help you avoid a complete coverage gap.

Does making fire hardening improvements guarantee I’ll find coverage?

Fire hardening significantly improves your insurability but doesn’t guarantee coverage, particularly in extreme wildfire hazard zones. Insurers consider multiple factors: your property’s location within hazard severity zones, proximity to other structures, access for firefighting equipment, local fire protection resources, and overall regional risk accumulation. Even fully fire-hardened homes in areas where insurers have concentrated exposure may face non-renewal as carriers reduce their maximum potential catastrophic loss.

However, fire hardening improvements do expand your coverage options—making you eligible for certain carriers who would otherwise decline your application and potentially qualifying you for premium discounts from insurers who do accept your property. Document all improvements thoroughly, as this evidence strengthens your applications across multiple carriers.

Old Harbor Insurance Services serves California homeowners with independent access to multiple carriers and coverage solutions. Located in Temecula and serving clients throughout Southern California, their team helps homeowners navigate the challenging insurance market with over a decade of experience and an A+ BBB rating. Contact Old Harbor at (951) 297-9740 or visit their office at 43015 Blackdeer Loop, Suite 201, Temecula, CA 92590.