Have you ever asked yourself what would happen if you lost your valuable camera before a trip or your precious engagement ring before your wedding?

Sounds unimaginable, but it does happen…

People lose their most precious and valuable items all the time. Apart from sentimental value, these items are often expensive too. You might not be able to afford a replacement immediately, even if you want one.

Thankfully, we have a solution for this. With scheduled and unscheduled personal property coverage, you can rest assured knowing that your personal possessions are secure!

So, what is scheduled and unscheduled personal property coverage all about?

Well, in this post, we dissect this topic and learn why it is important for renters and property owners alike. Here’s an outline of what you should expect:

- What is Scheduled Personal Property Coverage?

- What Is Covered By Scheduled Personal Property Insurance?

- What Is Not Covered By Scheduled Personal Property Insurance?

- How to Schedule Personal Property

- How Much Does Additional Scheduled Personal Property Insurance Cost?

- The Pros and Cons of Scheduled Personal Property Insurance

- What is Unscheduled Personal Property?

- What Does Unscheduled Personal Property Include?

- The Pros and Cons of Unscheduled Personal Property Coverage

- Final Thoughts on Scheduled vs. Unscheduled Personal Property Coverage

Continue reading to find out more…

What is Scheduled Personal Property Coverage?

Scheduled personal property coverage is an add-on to your homeowners’ insurance policy that provides extra protection for your valuable personal belongings like jewelry, expensive art, and antique collections.

It is also known by several other names such as endorsement, scheduled personal property endorsement, or scheduled endorsement.

Look! Your usual homeowners’ insurance does cover your home as well as most of the items inside. However, some of your possessions may be cumulatively worth more than your home itself.

In most cases, these items are not covered by standard homeowners’ insurance due to the limited coverage for such items on your policy.

This is where scheduled personal property endorsement comes into play. This supplementary insurance policy essentially provides extra coverage for your high-value items. So, you can expect full compensation in case anything happens to them.

What Is Covered By Scheduled Personal Property Insurance?

To understand what a scheduled personal property policy covers, we first need to know what a standard homeowner’s insurance covers! So, here we go!

Standard homeowners insurance has limitations, and it does not cover all types of property. Typically, homeowners’ insurance only covers your:

- Dwelling/home

- Structures within your home

- Basic personal property, such as clothing, furniture, and appliances

- Personal liability

- Loss of personal use

Many insurers essentially provide limited coverage for different types of property.

For instance, an insurer may place a limit of $1,500 on personal property. This means that if you lose your valuable $12,000 watch or camera, the insurance company will only pay $1,500 and you’ll have to pay the rest from your pocket.

Scheduled personal property insurance provides the much-needed coverage for such valuable items. Indeed you will pay a higher premium, but you can rest easy knowing that you’ll get a replacement in case your items are lost or stolen.

However, you must provide a full list of all the items you want to be covered, proof of ownership, and proof of value, including receipts, photos, and appraisals showing the true value of the items and that you are the real owner.

Here is a list of some of the items covered by scheduled personal property insurance:

- Furs, jewelry, and watches

- Antiques and collectibles like stamps and coins

- Expensive electronics and appliances e.g. cameras

- Musical instruments

- Firearms

- High-dollar sports equipment

- Documents stored in electronic media

It is always a good idea to scrutinize what your scheduled personal property policy covers to avoid last-minute disappointments. In case you need help finding the right policy for your needs, contact a reliable insurer near you!

“Good luck does not last forever, but good insurance does.” – Anonymous

What Is Not Covered By Scheduled Personal Property Insurance?

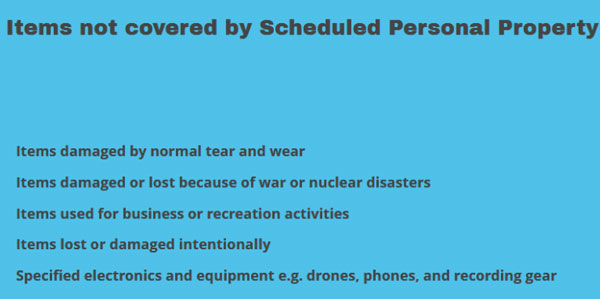

As much as a scheduled personal property endorsement provides extra coverage for your valuable items, it does not cover everything.

This supplementary insurance policy does not provide coverage for items damaged by nuclear disasters, war, insects or rodents, and normal wear and tear.

Moreover, scheduled personal property insurance does not cover items like sunglasses, phones, drones, and specific musical equipment like recording gear and microphones.

If you think scheduled personal property insurance will reimburse you for items lost through your business activities, then you are out of luck.

Like any other home insurance policy, a scheduled endorsement policy does not cover items that you use for business.

How to Schedule Personal Property

Are you wondering how to schedule your items for coverage?

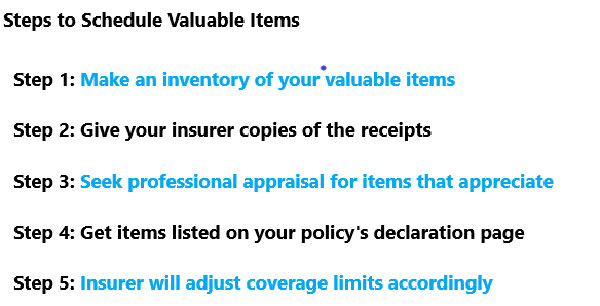

You do not have to be an insurance expert to know how to schedule your personal property. This process is straightforward – you won’t believe your eyes!

All you have to do is to make a list of all the valuable items you own and anything else you feel needs additional coverage. Then, give an independent insurance agent the list for further scrutiny. It’s as simple as that!

Your insurer will ask for the receipts of each item in order to assess their value. You may also have to enlist a professional valuer to appraise some of the items separately, especially when dealing with goods that appreciate in value over time.

The reason for appraising your valuables is to ensure that you obtain the correct coverage for your items. Regular appraisals may also help update your coverage limits accordingly to avoid disappointment when filing a claim.

How Much Does Additional Scheduled Personal Property Insurance Cost?

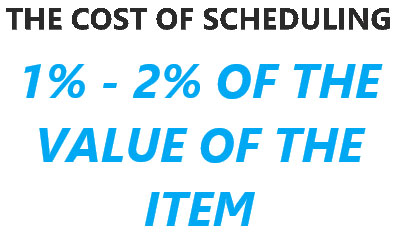

Having scheduled personal property coverage along with your standard homeowners’ insurance means you will pay higher premiums, but not by much.

Besides, the additional costs are worth every dime since you stand to enjoy extra protection in case of any misfortune.

The amount you have to pay for scheduled personal property coverage depends on the total value of your items.

Even though the rates vary between insurers, the annual premium rate does not go beyond 1 percent or 2 percent of the total value of the item.

For instance, if you have a camera that costs $5,000, you will only pay $50 or $100 every year in premiums to cover the item. However, each item is scheduled separately, meaning the total cost could rise depending on the number of items you want to cover.

The Pros and Cons of Scheduled Personal Property Insurance

Let’s face it. Every insurance policy has its upsides and downsides. Scheduled personal property coverage is, therefore, not an exception. The good news is that with this supplementary policy, the upsides clearly outweigh the downsides.

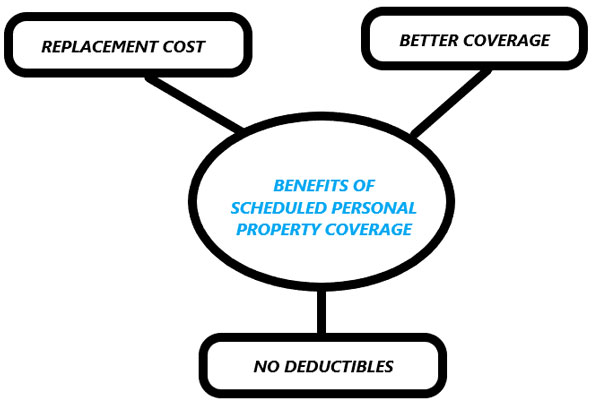

Scheduled personal property coverage offers three major benefits. These include:

1. Extended Protection (Broader coverage)

One major selling point of scheduled personal property insurance is that it provides much broader coverage than your standard home insurance policy.

Scheduling your property essentially comes with extended protection against greater risks not covered by other types of insurance. For instance, if your child accidentally drops your diamond ring down the drain, scheduled personal property coverage could compensate you for your loss.

2. Zero or Lower Deductibles

Most insurance policies come with deductibles, meaning you have to pay a certain amount out-of-pocket before your insurer can settle your claim.

Nonetheless, this is not the case with scheduled personal property coverage. Depending on the insurance company, scheduled personal property policies do not usually have deductibles on covered items.

3. Full Replacement Cost

Depreciation is usually a consideration in any property insurance policy. This means that if the value of your property was $5,000 a few years ago, but has depreciated to $2,000, the insurance company will only pay $2,000 when you file a claim.

Fortunately, this is not the case with scheduled items. With scheduled personal property coverage, the insurer is bound to pay the full replacement amount since depreciation is not a consideration in this type of policy.

The only shortcoming associated with scheduled personal property coverage is the effort you have to put into it. You have to create a list of all your valuables and attach relevant receipts for each item. This can be a real hassle for some people.

Then again, better coverage comes at a cost. If you have several high-dollar items that you want covered, you may have to dig deeper into your pocket to pay for the higher premiums.

Now that you know about scheduled personal property coverage, let’s delve into what unscheduled personal property is all about…

What is Unscheduled Personal Property?

Unscheduled personal property insurance, also known as non-scheduled personal property coverage is common terminology in the insurance sector.

Insurers often use this term to define personal belongings that have been covered under one standard insurance policy, but these possessions have not been itemized individually.

This insurance policy normally protects low-value items, such as clothing, inexpensive electronics, and furnishings that do not require individual appraisals or separate scheduling.

However, with an unscheduled personal property policy, limits and restrictions apply to the kind of coverage you should expect.

For instance, if you have a $500 limit for clothing coverage, you should not expect more than this amount when filing a claim for lost or damaged clothes, even if the value of your lost clothes is more than this.

Talking to an independent insurance agent near you can help you decide if you need extra protection for your unscheduled items.

What Does Unscheduled Personal Property Include?

As mentioned earlier, unscheduled personal property insurance covers low value items that do not need to be itemized individually. This coverage usually falls under your homeowners’ insurance policy since the value of the items does not necessarily warrant separate insurance.

You need to understand that unscheduled personal property coverage is limited to loss that occurs because of specific tragedies, such as fire or theft. It does not cover mysterious disappearances.

For instance, accidentally dropping your ring down the drain is considered a mysterious disappearance and it does not qualify for compensation under an unscheduled personal property policy.

Therefore, you should consider purchasing an unscheduled personal property policy for your low-value items and insuring your most valuable items separately under a different insurance policy.

Here is a list of items that qualify for an unscheduled personal property coverage:

- Common sports equipment

- Cheap jewelry

- Clothing

- Furniture

- Small electronics

- Kitchen appliances

- Cameras

The Pros and Cons of Unscheduled Personal Property Coverage

Unscheduled personal property coverage has its fair share of advantages and disadvantages. Here, we look at some of the top benefits and discuss the minor pitfalls of unscheduled personal property insurance.

The Pros

Blanket Coverage

Unscheduled personal property insurance provides blanket coverage for all your personal possessions. If you have lots of low-value items that require extra protection, unscheduled coverage could be just what you need.

Low Premiums

Since an unscheduled personal property insurance policy has a set coverage limit, it only means that you are entitled to pay lower premiums when compared with scheduled coverage.

No Appraisals Required

With unscheduled insurance coverage, you do not have to go through the trouble of appraising each item or searching for receipts. This is because the policy offers blanket coverage, making it more convenient and easy to follow up.

The Cons

Deductibles

With unscheduled personal property coverage, you have to pay a set deductible before you can file a claim for compensation.

Coverage Limits

Unscheduled personal property coverage is limited in how much you can get in case of a successful claim.

Final Thoughts on Scheduled vs. Unscheduled Personal Property Coverage

As you can see, the difference between scheduled and unscheduled personal property coverage is as clear as daylight. Each type has its advantages and disadvantages as far as providing you with extra coverage is concerned.

Now that you know the main differences between scheduled and unscheduled personal property coverage, it’s up to you to make a move and protect your possessions from any eventualities.

Talk to our agent at Old Harbor or visit our website to learn more about our extra coverage options.